Prior to now one month, costs of key staples — together with edible oils, rice, varied flours and greens — have risen sharply on a sequential foundation, based on retail and agribusiness executives, placing stress on kitchen budgets throughout the nation.

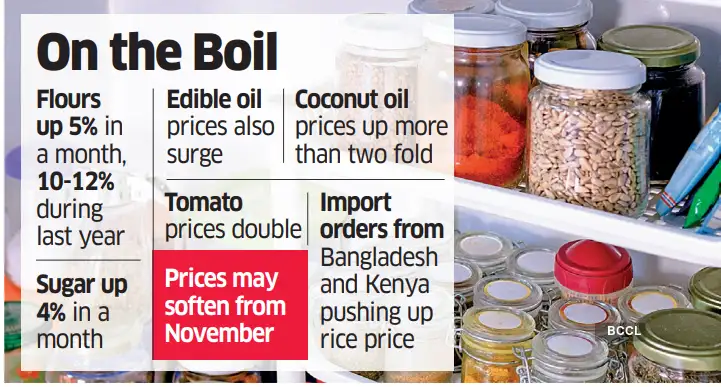

Costs of mustard and sunflower oil, rice, and tomatoes have jumped as a lot as 50% sequentially within the final two-four weeks. Wheat flour (atta), refined flour (maida), semolina (suji), and sugar have additionally seen value will increase of as much as 6% over the previous month and are 8-12% increased year-on-year.

A pointy depreciation within the rupee — from 85.90 per US greenback on July 15 to 87.82 on August 5 — has lifted the worth of imported edible oils.

“A two-rupee distinction in change fee makes imported oil pricey,” mentioned Angshu Mallick, managing director of AWL Agri Enterprise, the nation's largest packaged edible oil firm. Mallick additionally estimates mustard seed manufacturing at 10- 10.5 million tonnes this 12 months, properly under the federal government's forecast of 11.5-12 million tonnes. Economists have forecast the rupee to stay weak attributable to uncertainty round US tariffs. Mustard oil value has risen almost 30%, or Rs 40 per litre, over the previous three months.For soybean, sunflower and palm oils, the rise has been 10-15% within the final one month. “Costs of palm, sunflower, and soybean oil—that make up over 85% of India's edible oil consumption—have surged because the previous two months attributable to restricted provide and low inventories,” mentioned Rahul Guha, senior director at Crisil Rankings. Guha, nonetheless, mentioned the home weighted common costs are anticipated to witness a marginal decline year-on-year within the present fiscal given the affect of current responsibility cuts.

The customs responsibility on crude edible oils reminiscent of sunflower, soybean, and palm oils was halved in June to 10% to manage costs. The leap within the value of coconut oil has been a lot steeper than others: from Rs 160-170 per litre a 12 months in the past to Rs 480-490 within the coastal areas of Konkan and Rs 520-530 in Bengaluru.

The “unprecedented ranges of inflation” in copra has been pushed by a supply-demand hole created by a 9% drop in productiveness of coconut attributable to uneven climate patterns and unseasonal rains in April and Might, mentioned Saugata Gupta, chief govt of Marico, one of many largest gamers in branded coconut oil.

“Principally, it's the inelasticity of sure sources of demand that accentuates the demand provide hole throughout such occasions as copra can't be imported,” the CEO instructed analysts on Monday. Gupta, nonetheless, mentioned costs have began to melt a bit.

To make certain, general meals inflation stays contained at present, having peaked in 2022 and staying excessive until 2024. India's meals costs had been in deflation zone in June at -1.06% YoY attributable to decrease costs of greens, pulses, meat and fish, cereals, sugar, confectionery, milk and dairy merchandise, and spices, as per the most recent authorities information.

Trade executives mentioned the present spike in inflation in some commodities is short-term and may ease in two-three months when the brand new crop is available in.

Crisil's Guha mentioned the worth enhance of edible oil ought to ease after October-November harvest with higher yields anticipated for palm and sunflower.

BROAD-BASED RISE

Prior to now one month, costs of atta, maida, and suji have elevated 5-5.5%, whereas wheat is up 3%, exhibits trade information.

Executives attribute the rise in wheat value to inventory limits imposed on merchants, millers, wholesalers and retailers, pushing open market costs above the federal government's minimal assist value. Sugar costs at manufacturing unit gates are up 7-8% over final 12 months attributable to decrease crop yield, and have risen 4% within the final month, fueled by a decrease gross sales quota and competition demand. Rice costs too have surged 10-15% within the final two weeks after Bangladesh and Kenyan governments introduced plans to import rice.

Bangladesh will purchase 900,000 tonnes of rice, whereas Kenya will import 500,000.

Costs of the Swarna selection have elevated from Rs 29/kg to Rs 32.50.

“The present value motion is instantly linked to the export demand,” mentioned Keshab Kumar Halder, managing director of Halder Enterprise Ltd, an exporter of rice.