But when the change is as dramatic because it's cracked as much as be, why is the inventory market not impressed?

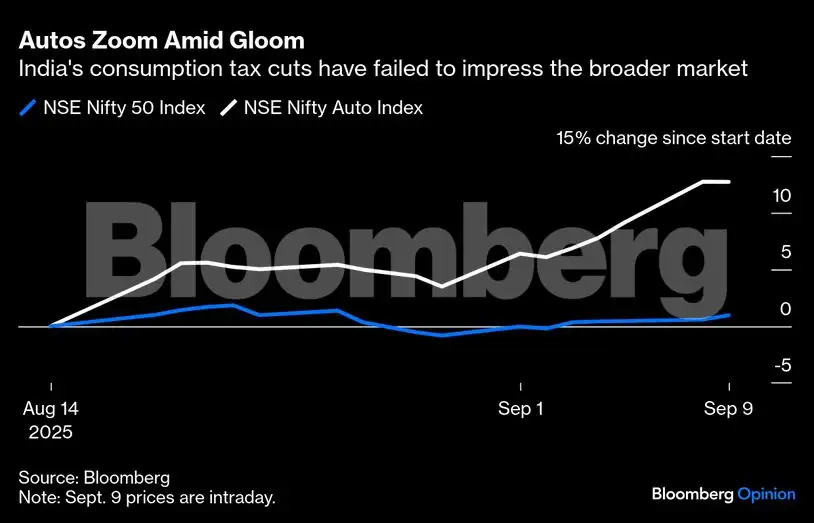

The tweaks to the eight-year-old items and companies tax had been introduced on Sept. 3, although Modi had flagged them as a “Diwali present” in an Aug. 15 speech. But the benchmark Nifty 50 Index has been largely unchanged since then. Auto shares have run up, however broader investor sentiment stays weighed down by US President Donald Trump's punitive 50% tariffs on India for its refiners' purchases of Russian oil. Actually, the very function of the rushed tax reduction is to compensate for export losses with extra home spending.

Perhaps the market is ready for Sept. 22. That's when small automobiles and lightweight bikes, in addition to different durables like TVs and air-conditioners, would slip into the 18% bracket, from 28% at current. At solely 5% GST, on a regular basis objects like cleaning soap, shampoo, and toothpaste would change into cheaper nonetheless. Well being and life insurance coverage premiums will change into tax-free.

Some hiccups are to be anticipated. Customers aren't satisfied that corporations will cross on the total good thing about decrease taxes. Corporations, in the meantime, have requested the federal government for extra time to clear their previous inventory. Auto sellers are fearful about losses on 600,000 items of unsold stock. And whereas insurance coverage insurance policies could certainly change into cheaper for shoppers on a post-tax foundation, their pre-tax costs should should rise to protect insurers' margins.

Bloomberg

BloombergHowever shouldn't markets be wanting past the pace bumps? Even when the tax cuts result in decrease costs with a lag, inflation is more likely to be decrease than the central financial institution's forecast of three.1% for the present monetary 12 months. That must create room for additional interest-rate cuts, bringing reduction to an financial system that has abruptly misplaced competitiveness in its largest export market.The principle purpose for the dearth of enthusiasm in fairness markets is that what's being offered as a reform is only a new price card. When the Modi authorities launched the GST in 2017, after strenuous fiscal bargaining with states, it claimed credit score for changing a maddening array of native levies with a unified nationwide tax.It was broadly understood again then that the subsequent large change would convey petroleum merchandise into the GST web and substitute a number of tax slabs — zero, 5%, 12%, 18%, and 28% — with a single price. Economist Vijay Kelkar, often called the architect of India's GST, urged a determine of 12%, to be shared between the federal, state and native governments within the ratio of 5:5:2.

However the altered model has met none of these targets. Exorbitantly priced gasoline and diesel — a supply of perennial unhappiness for the center class — stay exterior the GST. Useful resource-starved municipalities don't have a direct declare on income at the same time as local weather change batters their creaky infrastructure. And whereas the 12% and 28% tax brackets are going away, shoppers will nonetheless be going through three totally different slabs: 5% for so-called advantage items, a normal price of 18%, and 40% for tobacco, gentle drinks, and luxurious automobiles.

That isn't all. Chapatis will probably be tax-free, however solely when purchased from shops or consumed in eating places. Most households that make their each day bread at residence can pay 5% on wheat flour. The federal government's take from shirts and trousers priced below 2,500 rupees ($28) will probably be 5%, however pricier garments will entice an 18% cost.

In its quick life up to now, GST has emerged as an enormous avenue for graft funds. The federal government has promised to chop compliance prices. However and not using a decisive finish to pointless pink tape, misclassification, fraud, and corruption could proceed unabated.

GST 2.0 could not dazzle as a reform. However for it to succeed as stimulus, many transferring elements should chime in sync. Corporations should replace their billing and accounting software program. Earlier than they print new worth stickers, they should assess adjustments to their working-capital necessities, particularly if their output and enter fall in several tax brackets. GST incentives, supplied by many states to draw investments, would must be recomputed.

Even when corporations may be prepared within the 2 ½ weeks given to them, there's no assure that buyers will reciprocate. US tariffs have already hit labor-intensive industries like attire manufacturing. Any tightening of US immigration insurance policies might additional cloud the outlook for white-collar software program jobs which can be already below stress from synthetic intelligence. As an alternative of spending extra, had been households to make the most of the tax financial savings to fix their stability sheets in these unsure occasions, the stimulus might come unstuck.

That isn't how bond vigilantes are studying the tea leaves. If something, they appear to have change into extra sanguine of late. So long as shoppers don't postpone big-ticket purchases to attend for juicier reductions, the upcoming vacation season ought to elevate gross sales volumes. If the online hit to tax income will not be far more than the federal government's estimate of 480 billion rupees, there will probably be no purpose for federal and state administrations to hit the brakes on capital expenditure, notably infrastructure.

The cheery view is all right in concept, however will every thing go precisely to plan? The fairness market is correct to be cautious — placing an excessive amount of religion right into a price card might backfire.

(Disclaimer: The opinions expressed on this column are that of the author. The details and opinions expressed right here don't mirror the views of www.economictimes.com.)