The rise in tariffs poses some draw back threat to India's financial progress. Total, the US efficient tariff charge is now 17%, round 8 proportion factors decrease than April 3 estimate, when increased reciprocal tariffs have been initially introduced, it mentioned on Monday.

“The US tariff charge of 17% displays a 15% tariff charge on EU items, together with auto and auto elements, and better tariffs for main buying and selling companions Brazil, Taiwan, India and Switzerland,” it added.

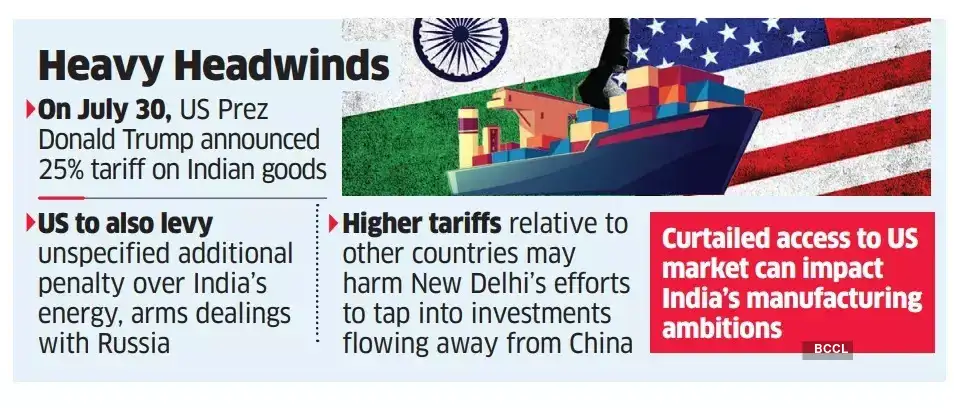

Final week, US President Donald Trump introduced 25% tariff on Indian items, together with an unspecified further penalty associated to India's power dealings with Russia.

Goldman Sachs on Monday minimize India's financial progress forecast to six.5% for 2025 and 6.4% for 2026, attributable to US tariffs. “In our view, a few of these tariffs are prone to be negotiated decrease over time, and additional draw back threat to the expansion trajectory primarily emanates from the uncertainty, ” it added.In keeping with HDFC Financial institution, the tariff poses a draw back threat of 20-25 bps to India's GDP progress. Christian de Guzman, senior vp, Moody's Scores, mentioned, “Curtailed entry to the most important economic system globally diminishes prospects for India's ambitions to develop its manufacturing sector, significantly in increased value-added sectors similar to electronics”.

He, nonetheless, added, “India's economic system is anticipated to stay resilient as it's much less trade-reliant than different massive economies within the Asia-Pacific.”