This mammoth quantity factors to a sobering socioeconomic actuality. Just one in 5 seniors in India is roofed by medical insurance. Practically 70% are financially depending on members of the family or on modest pension for his or her day by day wants.

But, the nation's silver financial system—items and providers consumed by the aged—is already estimated at Rs 73,000 crore and is projected to develop manifold within the coming years, in line with a NITI Aayog paper on senior care, launched final yr.

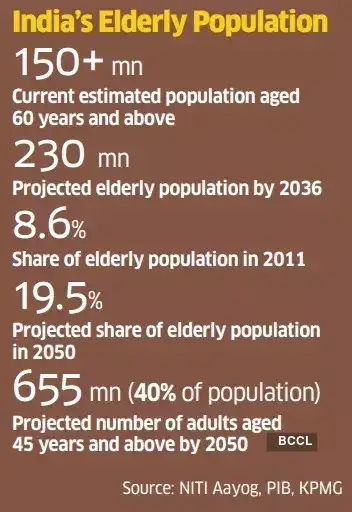

India stands at a pivotal demographic second, with its senior inhabitants set to rise to 230 million by 2036—greater than double determine in Census 2011. The nation's silver financial system may emerge as a strong development engine or the older inhabitants may change into a major pressure on households and public welfare programs.

The share of the aged in India's inhabitants is projected to rise from 8.6% in 2011 to 19.5% (round 319 million) by 2050, in line with the Longitudinal Ageing Examine in India (LASI) by the Ministry of Well being and Household Welfare. If one expands the lens to incorporate adults aged 45 and above, they may account for almost 40% of the inhabitants— an estimated 655 million individuals by 2050. Notably, the 45-64 age group is globally recognised because the cohort with the very best internet value.

MAKE SPACE FOR THE OLD

To serve this rising demographic, a number of corporations throughout industries are rolling out new and progressive services. The nation's main FMCG marketer, ITC, launched a devoted merchandise vary referred to as Proper Shift final yr. Ali Harris Shere, who heads ITC's snack meals and drinks division, says the group adopted a “Ctrl+Alt+ Delete” strategy to product innovation, primarily based on present analysis that reveals that from the 40s bone mineral density declines by 5-10% every dec-ade, whereas muscle mass reduces by 3-5%.

“We managed (Ctrl) components comparable to sodium and saturated fat and seemed for more healthy options (Alt)—for example, sugar was changed with jaggery, pink salt rather than white salt, entire grains in lieu of processed grains and so forth,” he says. “And we deleted added preservatives, added colors and synthetic flavours.”

Rumki Majumdar, economist at Deloitte India, says the nation's multi-billion-dollar senior care market presents important alternatives throughout actual property, healthcare, leisure, monetary providers et al, supplied an age-friendly ecosystem is developed. “Actual property might want to design self-sustaining senior residing communities that combine healthcare and leisure,” she says. She provides that healthcare too will seemingly change into more and more tech-intensive, which may assist make assisted residing, home-based care and digital well being providers extra accessible and scalable.

“The market penetration of senior residing in India is shockingly insufficient,” says Anuj Puri, chairman of actual property consultancy ANAROCK, including that it's barely 1%, in contrast with round 6% in markets comparable to US and Australia. He estimates the section may change into a Rs 64,500 crore market by 2030, with demand for almost 2.3 million senior residing models over the following 5 years.

Nevertheless, he cautions that senior residing just isn't a standard actual property play. “In contrast to in most common housing undertaking conditions, the place the developer's accountability ceases as soon as the housing society is handed over, the builder of a senior residing undertaking should keep intricately concerned all through the undertaking's lifecycle. Additionally, it entails partner-ship with specialist healthcare companies.”

Puri says the sector continues to be at a nascent stage, with solely about 15 builders comparable to Paranjape Schemes, Ansal API, Brigade Group and Ashiana Housing actively working on this area. “There are fewer than 80 such initiatives throughout the whole nation,” he says. “Practically 60% are situated in tier-2 and -3 cities, and about 68% of them are concentrated in South India.”

Southern states plus Himachal Pradesh and Punjab have a better share of aged individuals, a niche that's anticipated to widen additional by 2036. In Kerala, projections point out that almost one in 4 residents shall be a senior citizen by that yr.

THE CHALLENGES

In accordance with the well being ministry's LASI research, almost 75% of aged Indians stay with a number of continual situations, and 40% have no less than one incapacity. Diabetes is the commonest continual sickness amongst seniors in city India. The research additionally highlights a major psychological well being burden: round 20% of the aged expertise psychological well being points, and the estimated prevalence of despair is about 10 occasions larger than the speed of formally recognized instances, suggesting widespread underdiagnosis.

Healthcare bills stay a significant supply of economic stress, accounting for 26% of indebtedness among the many aged in city areas. The report provides that households with no less than one senior member have a decrease month-to-month per capita earnings than these with out ( Rs 3,568 vs Rs 4,098), underscoring the financial vulnerability of ageing households.

It presents a transparent image: whereas a rising aged inhabitants has the potential to gas new markets and financial development, it will probably simply as simply change into a heavy burden on households and the social welfare system if help constructions fail to maintain tempo.

At present, authorities initiatives for the aged embody the Atal Pension Yojana that ensures a minimal month-to-month pension of Rs 1,000 to Rs 5,000, Atal Vayo Abhyuday Yojana for empowering the aged, and the Built-in Programme for Senior Residents, a grant-in-aid scheme.

In accordance with former Union well being secretary Lov Verma, each giant hospital in India ought to have a devoted geriatric division. “We're more likely to see a speedy development in rising segments comparable to wearable well being gadgets, as persons are turning into extra well being acutely aware,” he provides. “However robust civil society interventions shall be important to make sure an ample pool of caregivers for the aged, particularly these residing with dementia.”

In accordance with World Well being Group (WHO) estimates, round 50 million individuals have dementia globally, a quantity projected to triple by 2050. India at the moment has about 4 million dementia sufferers, which may rise to 13.4 million by 2050. The worldwide financial burden of dementia is already estimated at $1 trillion yearly.

This raises a vital query: Are India's hospitals—private and non-private—ready for what lies forward?

Sandeep Budhiraja, group medical director of Max Healthcare, says almost 26% of three.6 million sufferers at Max hospitals yearly are senior residents. “This section is a key focus space for us,” he says. “We have now designed a number of initiatives to deal with their wants. These embody devoted geriatric care programmes, precedence entry and personalised follow-ups.”

Recognising that India's silver financial system displays each a major alternative and a urgent accountability, Budhiraja stresses the necessity to shift from episodic, illness-driven remedy to complete, continuum-of-care fashions that promote wholesome and dignified ageing. “We imagine the silver financial system isn't just about longevity, however about enabling senior residents to stay more healthy, extra unbiased and fulfilling lives—with entry to high quality healthcare at each stage of ageing,” he provides.

START AT 50

In KPMG's March 2025 report, “The Rise of Silver Technology: Reworking the Senior Residing Panorama”, its companion Chintan Patel argues that the very definition of senior residing wants rethinking.

“Historically linked to the retirement age of 60, senior residing ought to maybe start at 50+, aligning with life-style shifts the place youngsters typically transfer out for schooling and work,” he writes. “Shouldn't we redefine senior residing to cater to energetic adults at 50+, specializing in independence, engagement and wellness slightly than simply ageing care?”

Whereas a small section of high-income professionals might take early retirement and spend their 50s on cruises or journey, the fact for many Indians is starkly totally different. At 60, common earnings cease, and plenty of battle to take care of even modest life. Majumdar argues that the reply lies in guaranteeing that financial participation doesn't finish with a sure age. “Skilling programmes for older adults and versatile work fashions can lengthen productive years,” she says, pointing to part-time roles, public service contracts in sectors comparable to schooling, and micro-enterprise credit score strains as viable pathways.

“Because the demographic dividend fades, India should pivot to an age-inclusive financial system that leverages longevity tech, eldercare financing and age-friendly infrastructure to remodel ageing from a problem right into a development engine,” she provides.

India's silver financial system will shine if its silver technology is empowered to take part, not pushed to the sidelines. In any case, age provides worth, if society makes room for it.