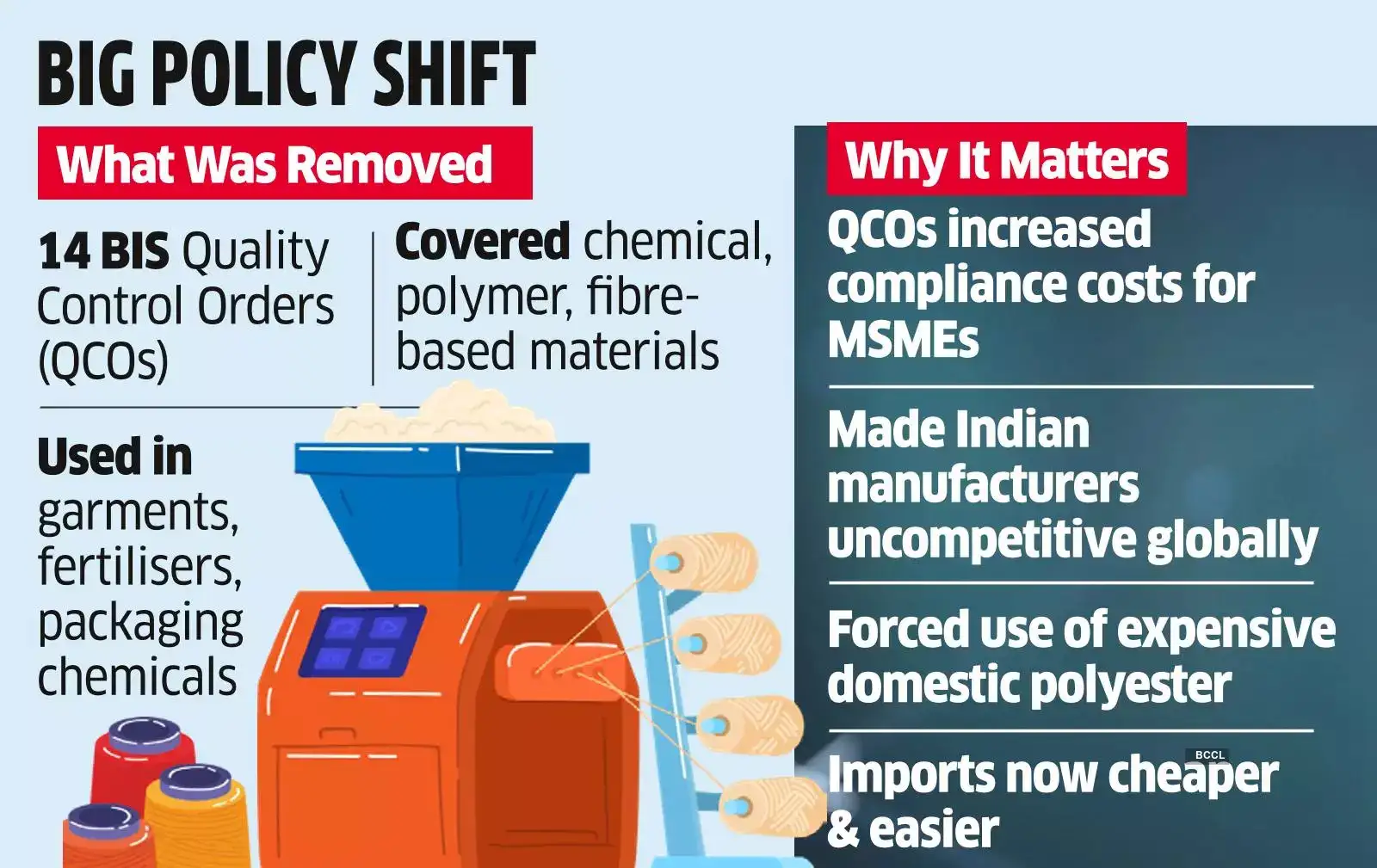

The QCOs, that are obligatory certifications given by the Bureau of Indian Requirements (BIS), elevated compliance prices for small companies, resulting in larger costs for customers and decreased competitiveness, particularly for micro, small and medium enterprises (MSMEs) and export-oriented industries.

The rescinding of QCOs signifies a significant shift in direction of trade liberalisation and decreased regulatory burden in a significant reduction to the chemical, plastics and textile sectors.

Globally, about 70% of the clothes are made utilizing artificial fibre, and Indian exporters have been unable to compete as they have been compelled to purchase costly domestically produced polyester fibre and yarn.

The chemical compounds and fertilisers ministry eliminated the QCOs on Wednesday, a transfer that may make the Chinese language polyester fibre obtainable to Indian garment and material producers at 20-25% decrease charges than the home polyester, mentioned trade executives.

The transfer will guarantee uncooked materials availability, ease import constraints and decrease enter prices for downstream MSMEs within the packaging, textile and moulding sectors.”The choice of rescinding QCO on polyester fibre and yarn is an enormous transfer to make India aggressive in MMF (man-made fibre), which has 70% market share. With the already bagged FTAs (free commerce agreements) and Europe negotiations on quick monitor, India appears set to turn into a worldwide chief in attire and textiles,” mentioned Sanjay Jain, former chairman of the Confederation of Indian Textile Business.The Southern India Mills' Affiliation mentioned the initiative would assist stop the closure of a number of energy loom items which are on the verge of changing into non-performing property as a result of non-availability and lack of required fibres at aggressive costs. Its chairman, Durai Palanisamy, mentioned, “Many home producers of consolation put on and technical textile merchandise had been struggling to obtain fibres at globally aggressive charges, leading to a lack of market share constructed over many years. Exporters have been dropping confirmed orders, as international patrons usually insisted on sourcing fibres from nominated worldwide suppliers, placing Indian producers at a drawback.”

Jain mentioned it was a long-standing demand of trade to offer a stage taking part in subject to it as MMF constitutes the majority of the worldwide trade and India was rendered uncompetitive resulting from very excessive uncooked materials costs, in comparison with these in China, Bangladesh and Vietnam.

Home customers are additionally anticipated to learn as costs of polyester-based clothes will cut back. The central authorities had earlier eliminated import responsibility on cotton, which is anticipated to end in document import of cotton in 2025-26.

Though the worldwide textile and attire sector is dominated by MMF, it's the different means round in India, the place cotton dominates. With limitations on availability of cotton, the native trade was not rising, a stark distinction to rivals comparable to Bangladesh, Vietnam and Thailand.

“Polyester fibre and polyester yarn type many of the man-made fibre merchandise, and therefore, this measure by the authorities will contribute to the expansion of the MMF phase in India,” mentioned Ashwin Chandran, chairman, Confederation of Indian Textile Business.

India had imposed QCOs on man-made fibres between 2022 and 2023, whereas earlier an anti-dumping responsibility on these fibres and their uncooked supplies was in place.

The elimination of the QCOs will make it simpler to acquire uncooked supplies at internationally aggressive costs. “Coupled with the export bundle introduced on November 12, the rescinding of those QCOs will act as an enormous confidence-booster for the textile and attire sector,” mentioned Chandran.

The Confederation of Indian Textile Business has requested the federal government to offer comparable reduction on QCOs for viscose fibre and different cellulosic uncooked supplies as India goals to create a $350 billion textile and attire trade by 2030, with exports contributing $100 billion.