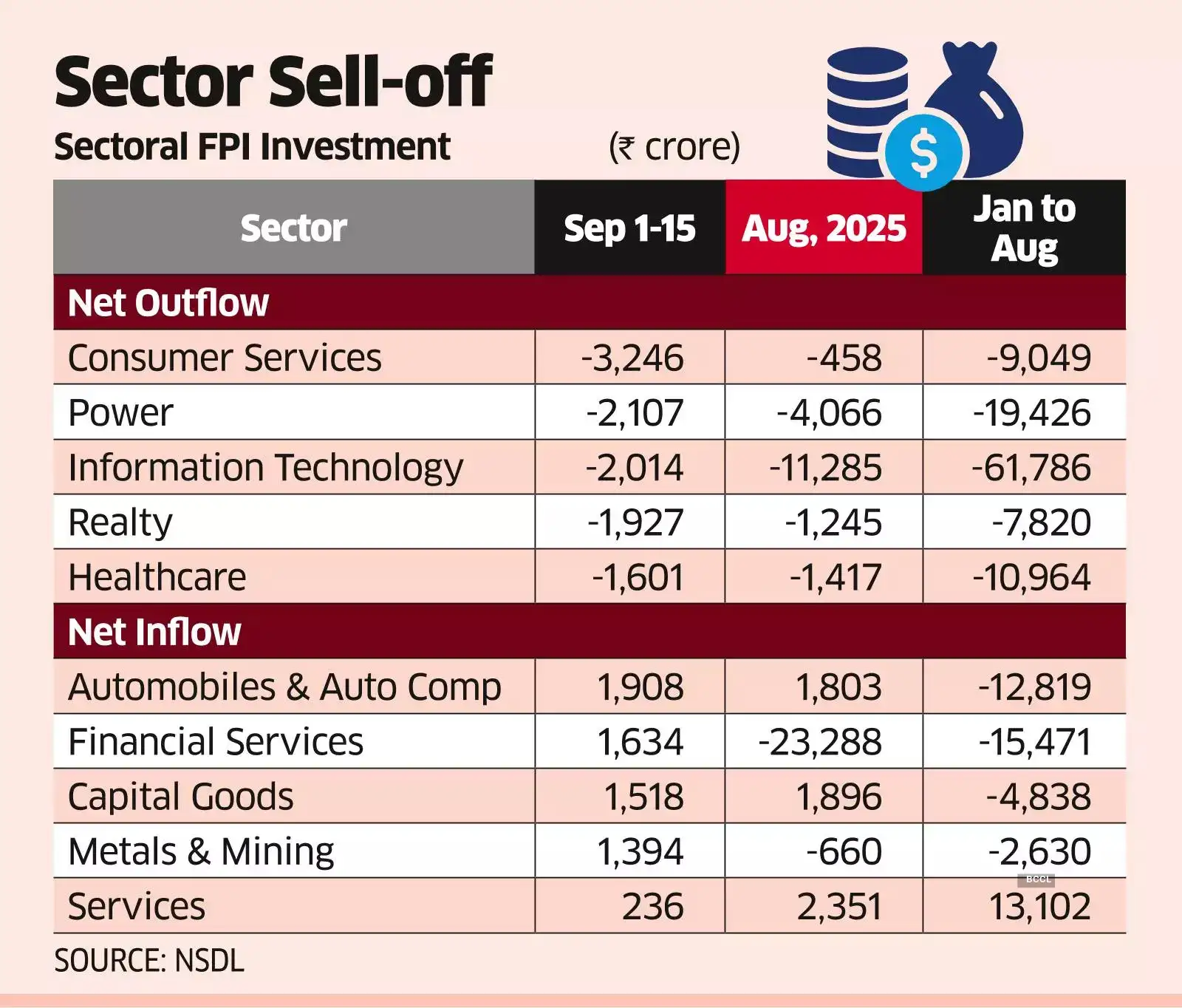

Abroad traders offloaded ₹3,246 crore price of shopper providers shares within the first 15 days of September, after promoting ₹458 crore within the earlier month, NSDL information confirmed. IT and energy shares additionally remained below strain, with international traders pulling out greater than ₹2,000 crore from every sector in the course of the interval. In August, that they had bought ₹11,285 crore price of IT shares and ₹4,066 crore in energy. “In energy, margin pressures rose from unstable gasoline prices and forex depreciation, inflicting doubts about profitability,” mentioned Om Ghawalkar, market analyst, Share.Market. “The promoting indicators a tactical pullback reflecting danger administration relatively than a elementary shift away from these sectors.”

U R Bhat, co-founder & director, Alphaniti, mentioned IT shares stay susceptible. Considerations across the US transfer late final week to boost the one-time value of H-1B visas may end in extra promoting quickly.

Amid the broader promoting, the monetary providers sector recorded international inflows of ₹1,634 crore within the first half of September after an accelerated sell-off of greater than ₹23,000 crore in August and complete outflows of ₹15,471 crore between January and August.

“The monetary providers sector is basically domestic-oriented and the valuations within the sector stay affordable, particularly these of state-owned lenders,” mentioned Bhat. “The banking shares provide a safer guess to international traders whereas international uncertainty persists.” The Financial institution Nifty Index gained 1.2% final week, outpacing the benchmark Nifty's 0.9% rise. “FPIs seem like banking on a cyclical rebound pushed by resilient mortgage demand and bettering asset high quality,” mentioned Ghawalkar. “This reversal additionally displays worth shopping for after sharp corrections.”

In complete, international traders bought ₹16,737 crore throughout 15 sectors in the course of the first half of September. Realty (₹1,927 crore), healthcare (₹1,601 crore), telecom and oil & fuel (over ₹1,500 crore every) had been amongst different main laggards.

On the similar time, abroad traders pumped ₹6,976 crore into eight sectors. Cars attracted probably the most with ₹1,908 crore, adopted by capital items (₹1,518 crore) and metals & mining (₹1,394 crore).