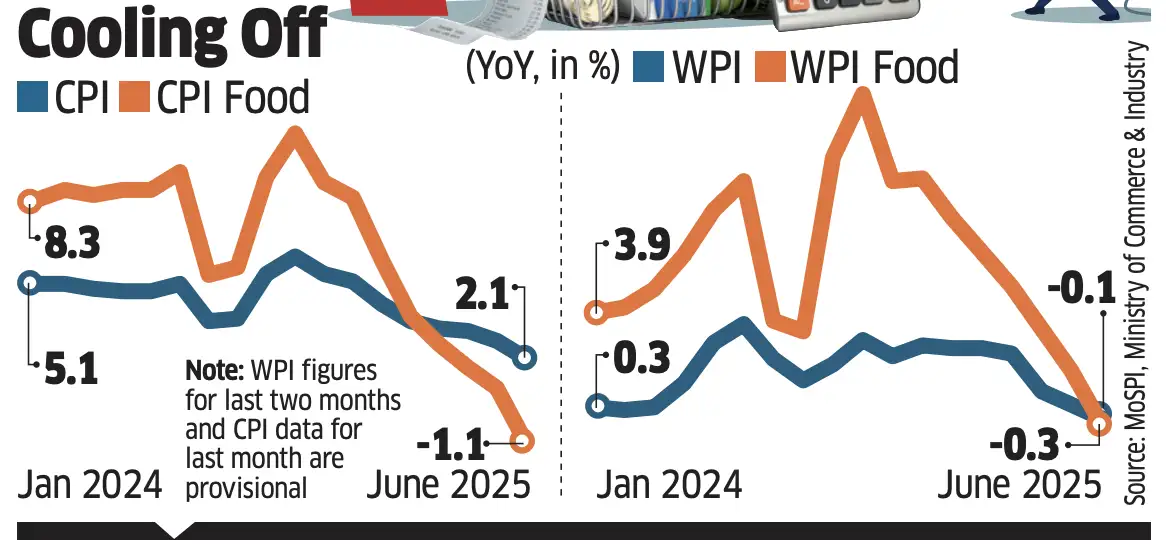

The RBI is remitted to focus on 4% retail inflation inside the vary. That is the fifth consecutive month that CPI inflation has printed under 4%. Retail inflation is at its lowest since January 2019, when it was 1.97%.

The Wholesale Worth Index (WPI) slipped into the deflation zone, hitting a 20-month low of -0.1% in June in opposition to 0.4% in Could. The drop within the inflation fee was pushed by a decline in meals and gas costs and a moderation in manufactured items. ICRA chief economist Aditi Nayar mentioned a 25 bps lower in August can't be dominated out, persevering with the cuts seen this yr in June.

Others didn't concur.

“This quantity is not going to have any impression on the coverage determination and therefore a established order may be anticipated,” mentioned Madan Sabnavis, chief economist at Financial institution of Baroda.

ET Bureau

ET BureauStimulus for Demand

CareEdge chief economist Rajani Sinha mentioned, “The Reserve Financial institution of India has already front-loaded the speed cuts anticipating moderation in inflation, therefore we don't anticipate additional fee cuts, except financial development weakens materially.”A foundation level is 0.01 share level. In its final coverage announcement on June 5, the RBI lower the repo fee by greater than anticipated 50 foundation factors, delivering a cumulative one share level discount in calendar 2025 to spice up demand. It additionally lowered the money reserve ratio (CRR) by 100 bps, however shifted its stance to impartial from accommodative, suggesting a pause on financial motion.Nayar causes {that a} slowing financial system might convey an August fee lower by the central financial institution's financial coverage committee (MPC).

“Given the weak spot in a majority of the out there high-frequency indicators, we foresee the gross home product (GDP) development to print at 6.0-6.5% in Q1FY26, the information of which can solely be out there at end-August i.e. after the MPC's assembly,” mentioned Nayar.

The Centre will launch GDP information for the June quarter in August. The MPC meets August 4-6.

Low inflation is predicted to assist prop up demand.

“The declining inflation is predicted to supply a big increase to the true wages of the households in FY26,” mentioned Paras Jasrai, affiliate director at India Rankings and Analysis (Ind-Ra). Jasrai mentioned yet another 25 foundation level lower may nonetheless happen this fiscal yr except there are surprises from international developments or development hits a hunch.

Meals inflation

The common retail inflation fee was at a 25-quarter low of two.7% within the June quarter, decrease than the central financial institution's forecast of two.9%, whereas common wholesale inflation dropped to a five-quarter low of 0.4%. Meals inflation, a significant element of CPI, slipped to deflation, coming in at -1.1%, the bottom in over six years.

Core inflation, which excludes unstable meals and gas costs and alerts demand pressures, rose to 4.4% in June, the best since September 2023, largely resulting from an uptick in jewelry. Meals inflation dropped resulting from a beneficial base impact and a fall in costs of greens (-19%), pulses (-11.8%), and meat & fish (-1.6%). Cereal inflation hit a 41-month low of three.7%.

Out of twenty-two main states and union territories, 10 recorded inflation above the nationwide common, with Kerala main at 6.7%, adopted by Punjab (4.7%), Jammu and Kashmir (4.4%), Uttarakhand (3.4%), and Haryana (3.1%).

“Such variation is symptomatic of various meals costs resulting from producing and consuming states being aside,” mentioned Sabnavis.

Wholesale inflation

Meals inflation, which accounts for round one-fourth of the WPI weight, fell to a two-year low of -0.3% in June from 1.7% in Could.

Main contributors to meals deflation included onions (-33.5%), potatoes (-32.7%), greens (-22.7%), and pulses (-14.1%). Fruit costs eased to 1.6% year-on-year in June in comparison with 10.2% in Could.

“The drop in costs of pulses was resulting from a strong kharif output,” mentioned Jasrai.

Inflation in manufactured merchandise, which account for 64.23% weight within the WPI, eased barely to 1.97% in June from 2.04% in Could. Inside this class, vegetable & animal oils and fat recorded the best inflation at 23.1%, adopted by meals merchandise (7%), and tobacco merchandise (2.8%). Inflation in main articles and gas & energy contracted by 3.4% and a pair of.7%, respectively.

“The gas & energy and crude petroleum and pure gasoline costs declined throughout June resulting from benign international commodity costs,” mentioned Jasrai.