The banking regulator can also be contemplating a provision to supply extra compensation in instances the place a criticism is resolved on the degree of the RBI or the RBI Ombudsman, stated folks acquainted with the event.

These proposals are being mentioned as a part of a complete framework on compensation to prospects and therapy of complaints.

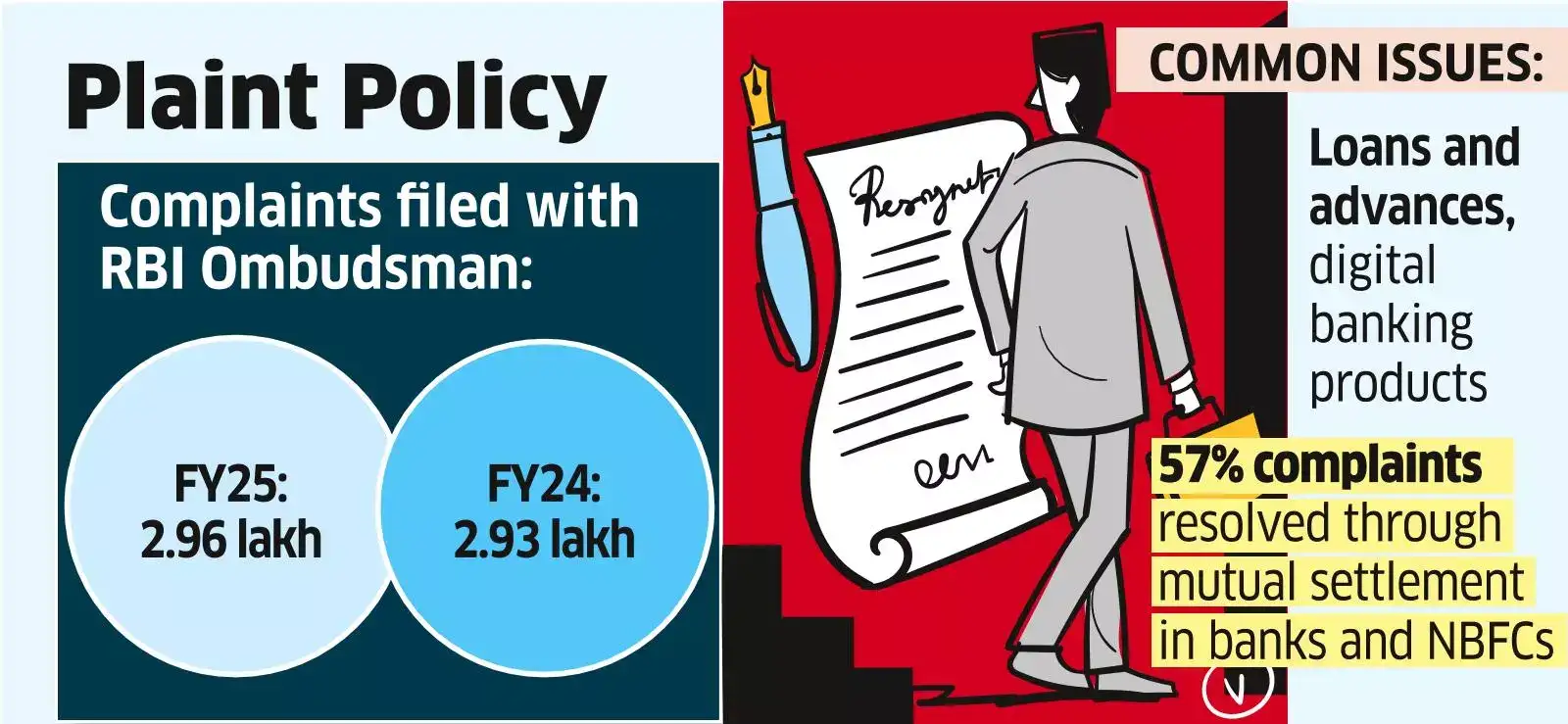

On Wednesday, after the financial coverage evaluation, the central financial institution stated it is ombudsman scheme is being revised to enhance the grievance redressal system for client complaints and guarantee that redressal system of regulated entities is more practical. Additional, rural co-operative banks will even be included underneath the RBI Ombudsman scheme.

The evaluation seeks to reinforce readability, simplify procedures and cut back timelines to additional enhance well timed, honest, and efficient redress and the draft Scheme shall be positioned on the Reserve Financial institution's web site shortly for searching for suggestions from stakeholders, it famous.”Options have been sought from banks on a few of these points. Most lenders have supported the case for a uniform compensation coverage however with flexibility, making an allowance for completely different threat profiles and product range,” stated a financial institution govt, who didn't want to be recognized.Queries emailed to the RBI didn't elicit a response until press time.

The proposed reforms will embody introduction of a two-tiered construction inside REs for grievance redress previous to escalation to the Inside Ombudsman (IO) and that they be outfitted with compensation powers and be allowed entry to the complainant, aligning the function of IOs extra carefully with that of the RBI Ombudsman.

Most banks, nonetheless, are in opposition to extra compensation if the problem is resolved on the degree of the regulator. “Generally the complaints might be exaggerated, and the shopper would take it to the very best authority for searching for most compensation, which may put undue pressure on the prevailing grievance redressal mechanisms,” stated the financial institution govt.

Banks have additionally made a illustration by way of the Indian Banks' Affiliation and sought extra time to completely adapt their methods and automate information submission as per new mandates.