Earlier than Trump's announcement, most economists had anticipated no change in charges following the governor's cautious stance within the June coverage assembly. The bulk — 23 out of 34 economists surveyed by Bloomberg — nonetheless anticipate the Reserve Financial institution of India to carry this week, however a couple of banks have modified their forecasts lately.

Soumya Kanti Ghosh of State Financial institution of India Ltd., the one economist to accurately predict the RBI's shock larger-than-expected charge reduce in June, and Dhiraj Nim of Australia & New Zealand Banking Group, now predict a quarter-point easing on Wednesday to defend Asia's third-largest economic system.

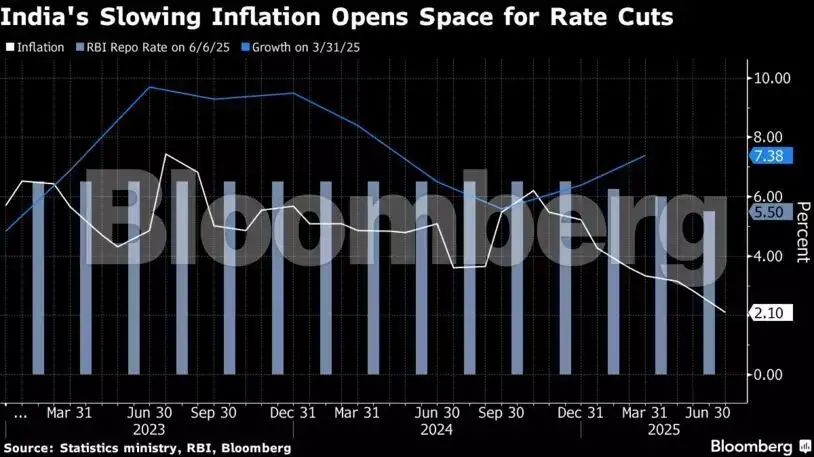

The RBI has reduce the benchmark repurchase charge by 100 foundation factors since February to five.5%, together with an unexpectedly massive reduce in June. Since then inflation has eased to the bottom stage in additional than six years, whereas Trump has hit India with a 25% tariff charge and threatened extra penalties, clouding the expansion outlook.

Bloomberg

BloombergFinal month, Governor Sanjay Malhotra stated there was room for additional cuts, although the brink for relieving stays excessive. The central financial institution can also be anticipated to keep up its “impartial” coverage stance, giving rate-setters some flexibility amid world uncertainty.

SBI's Ghosh stated there's “no level” in holding off on charge cuts now as inflation will proceed to remain under the RBI's 4% goal on this fiscal yr and across the stage subsequent yr. A front-loaded reduce now would assist enhance festive-season spending and push credit score development, he stated.

Nevertheless, the central financial institution ought to pause as soon as the repo charge dips to five.25%, stated Ghosh. The repo charge was at 5.15% simply earlier than the pandemic in February 2020, the bottom it had dipped until then. Through the pandemic, the RBI drove down the important thing charge additional to 4%, however 5.15% ought to stay the “charge flooring” for peculiar occasions, he stated.

Different economists like Aastha Gudwani of Barclays Financial institution Plc. stated the case for additional financial easing is “not but compelling sufficient.” On condition that the transmission of earlier RBI cuts to financial institution lending charges and negotiations of commerce talks with the US are nonetheless underway, the RBI “would select to attend this coverage out and let these occasions unfold, thereby protecting the powder dry,” she wrote in a notice to purchasers.

With the US Federal Reserve holding rates of interest regular and extra strain on the rupee, there may be additionally little incentive for rising markets similar to India to ease coverage additional, analysts stated.

Right here's what market watchers will regulate when Malhotra publicizes the speed choice in a televised tackle at 10 a.m. in Mumbai:

Inflation and Progress

India's headline inflation eased to 2.1% in June, under the RBI's goal for 5 months in a row. That, together with good monsoon and inspiring progress on sowing, will preserve worth features under the RBI's 3.7% projection within the present fiscal yr that began April.

Then again, Trump's tariffs on India — greater than Asian rivals like Vietnam and Indonesia — might probably shave as a lot as 30 foundation factors from development. Analysts will carefully watch RBI's evaluation of the US tariff affect on development and inflation to gauge the long run coverage path.

The RBI will seemingly decrease its “inflation and development forecasts and supply dovish steerage to help financial coverage transmission,” stated Santanu Sengupta, an economist at Goldman Sachs Group. He pegs inflation for the fiscal yr at 3%.

Liquidity Measures

Bond merchants will search extra readability from the central financial institution on the extent of surplus liquidity it considers applicable, following its current cash-draining operations. Additionally they anticipate the RBI to launch an up to date liquidity administration framework to make sure its charge selections are successfully handed by way of to the broader economic system.

Bloomberg

BloombergThe RBI's choice to empty short-term money after the CRR reduce in June confused merchants. As in a single day charges spiked above the coverage charge, the central financial institution was compelled to inject short-term liquidity.

At present, extra liquidity within the banking system stands at 3.3 trillion rupees. With the CRR reduce taking impact in tranches beginning in September, one other 2.5 trillion rupees is predicted to be added.

Bonds and Rupee

Rate of interest swaps counsel the RBI will preserve charges regular in August, with solely a modest likelihood of a quarter-point reduce in October, in keeping with Financial institution of India Funding Managers Pvt.

“Ought to inflation display sustained moderation—particularly core inflation—yields might soften, notably within the medium and lengthy segments of the curve,” stated Alok Singh, chief funding officer on the agency. “Conversely, any hawkish surprises or exterior shocks might drive yields greater.”

India's 10-year benchmark bond has risen about 10 foundation factors over the previous two months, after RBI raised the bar for relieving and began draining liquidity.

Merchants may also look ahead to the central financial institution's commentary on the rupee, which is hovering close to its document low seen in February. A charge reduce might weaken the foreign money additional by making native property much less engaging.