A few of them have been questioned by the Revenue-tax (I-T) division for submitting returns below a bit of the regulation that generally permits a decrease tax outgo.

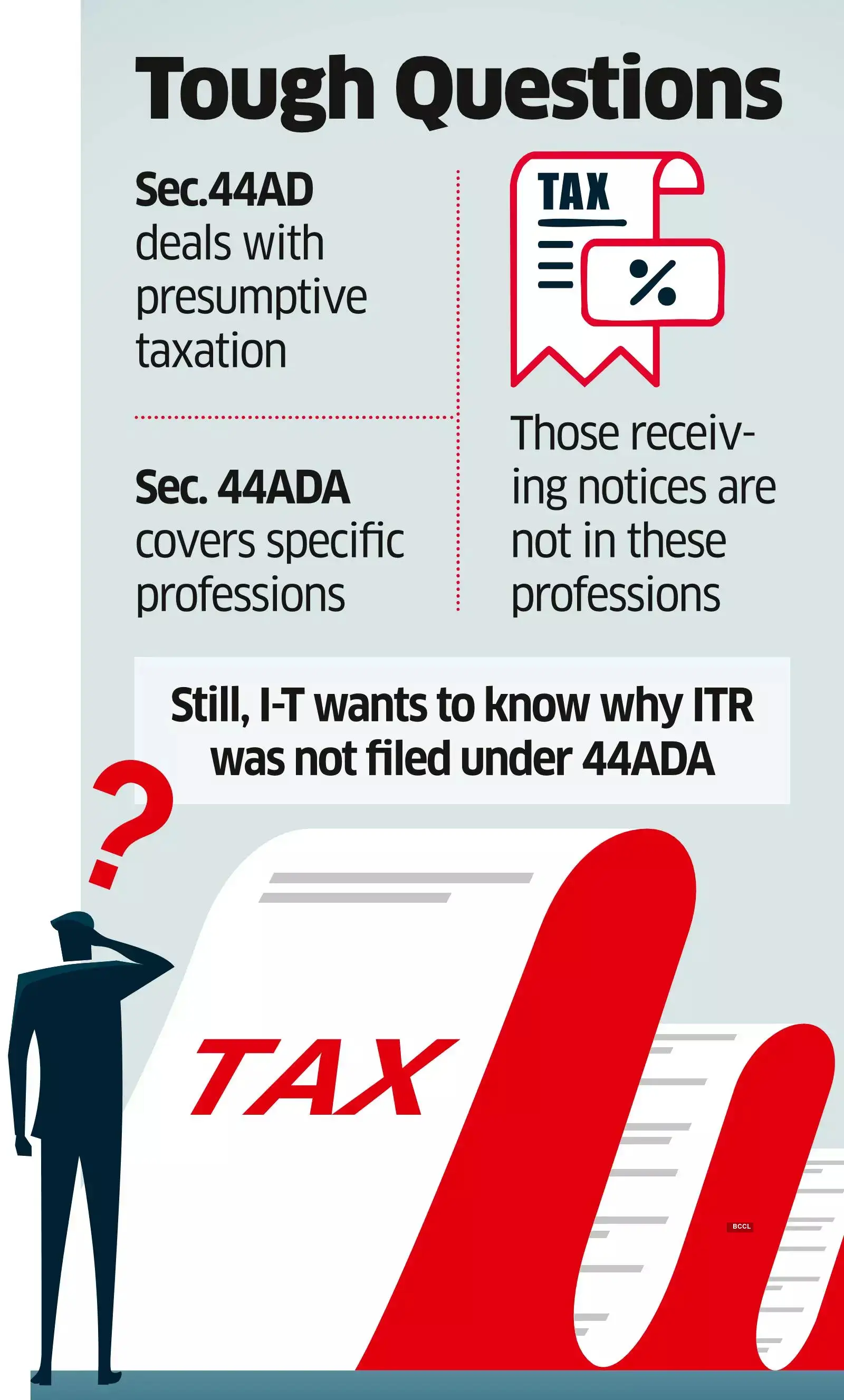

Within the scrutiny notices they've obtained, the tax division identified that they need to have filed below Part 44ADA of the I-T Act-meant for choose professionals-and not below 44AD which provides a simplified presumptive tax window.

Nonetheless, the dilemma earlier than these taxpayers is that they don't qualify below the listing of execs (specified within the regulation) who're eligible to pay tax and file returns below 44ADA.

These specified professionals, supplied in Part 44AA, embrace individuals engaged in authorized, medical, engineering, architectural, technical consultancy, inside ornament, movie artist, authorised consultant, chartered accountants, firm secretary, and professionals within the info know-how sector.

So, it is generally understood that individuals in professions outdoors this listing come below Part 44AD. Resident people, Hindu undivided households (HUF), and partnerships (excluding restricted legal responsibility partnerships) are lined below Part 44AD so long as the individuals should not within the listing of professions listed below Part 44AA (for whom 44ADA would apply).

Individuals not making ready books of accounts and claiming no deduction will pay I-T on 6-8% of their gross receipts, as per Part 44AD -a reduction to companies individuals with turnover under ₹2 crore. Sometimes, in step with the language of the regulation and to keep away from being pulled up by tax authorities, most Part 44AD assesses pay tax on the stability revenue after deducting sure bills.

Underneath Part 44ADA, professionals (within the specified listing) report their taxable revenue at 50% of gross receipts if their revenue from the exercise is inside ₹75 lakh.

Practitioners stated the explanation professionals and consultants who've filed ITR below Part 44AD -and at the moment are being requested why they'd not filed below Part 44ADA -is as a result of the tax workplace software program has picked their circumstances for scrutiny on how their shoppers had paid the tax deducted at supply (TDS). Their prospects and shoppers have deducted 10% TDS below Part 194J -consciously selecting the next TDS charge once they might have deducted 2% TDS below a unique part (194C) -to hold tax officers at bay.

“The truth that tax has been deducted below a particular provision (Part 194J), and the revenue has not been declared below Part 44ADA, shouldn't, by itself, type the premise for choosing circumstances for scrutiny. TDS below Part 194J doesn't, in itself, make an assessee eligible for taxation below Part 44ADA. The profit below Part 44ADA is strictly restricted to professions specified below Part 44AA(1). Notably, sure professions, similar to these associated to sports activities, might fall below the ambit of Part 194J with out being categorised as professions below Part 44AA, therefore, outdoors the scope of Part 44ADA,” stated Ashish Karundia, founding father of the CA agency Ashish Karundia & Co.

The Supreme Court docket, he stated, has persistently interpreted the time period ‘enterprise' in a broad sense, extending past mere commerce or manufacturing. It encompasses professions, vocations, and callings, recognising actions which might be carried out repeatedly and systematically with the appliance of ability and energy to earn revenue. Thus, except an individual is engaged in a occupation particularly listed below Part 44AA(1), or derives revenue from fee or brokerage, or operates an company enterprise, the presumptive taxation scheme below Part 44AD stays accessible and isn't restricted, stated Karundia.

These receiving such notices ought to rigorously study the true nature of their activities-whether they fall below “enterprise” or “occupation” as outlined within the Revenue-tax Act, in line with Paras Savla, a CA.

“If their work is genuinely within the nature of enterprise (not skilled providers notified below part 44AA), they'll reply with correct documentation to justify their submitting below 44AD. Merely the truth that TDS was deducted below part 194J doesn't routinely imply the revenue is “skilled revenue.” Additional, if the taxpayer's exercise is nearer to a enterprise contract (not knowledgeable service), shoppers might deduct TDS below 194C as an alternative of 194J to keep away from mismatches. Nonetheless, shifting to 194C might create compliance points for shoppers because the division usually scrutinises such reclassification. Shoppers will need to make sure the association is defensible as a ‘contract' somewhat than a ‘skilled service'”, stated Savla.