A proposal on this regard could also be moved for the consideration of the GST Council, the apex decision-making physique for the oblique tax, at its upcoming assembly in August after the monsoon session of parliament.

The finance ministry will attain out to states to construct a political consensus on taking the reforms ahead. It has already begun inter-ministerial consultations with key stakeholder departments on the proposed transfer, stated the folks cited.

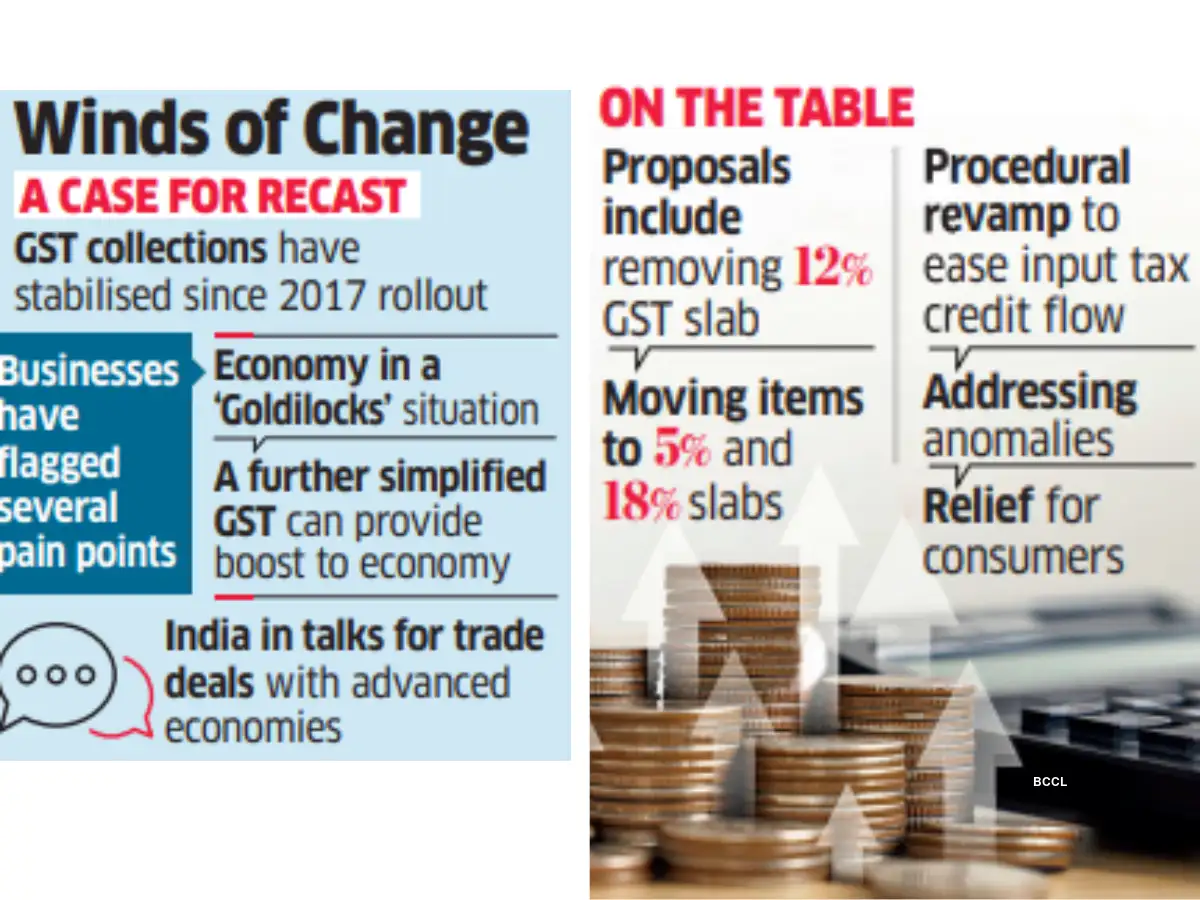

The revamp will cowl each slab modifications and procedural simplification to offer aid to customers in addition to companies, they stated. A ministerial panel has been mandated by the GST Council to have a look at the speed rationalisation nevertheless it has made little headway.

Trade has over the previous few months made a powerful case to the federal government for a recast of the GST framework together with charges, slabs and procedures, whereas flagging quite a few ache factors.

Fewer Slabs Proposed

Lawmakers throughout get together strains have additionally highlighted points associated to GST and the necessity to handle them. GST at the moment has 5 key slabs — nil, 5%, 12%, 18%, 28% — and two — 0.25% and three% — for bullion.

The 5% slab has about 21% of all items below GST. The 12% slab has 19% of things, whereas the 18% slab has 44% of things. The very best charge of 28% covers 3% of whole items.

A key proposal being examined is scrapping the 12% slab and transferring objects to the 5% or 18% slabs.

Detailed discussions have been held on the highest stage within the authorities and policymakers are of the view {that a} simplified GST regime might give an additional enhance to the financial system, stated one of many individuals.

The time is opportune for the recast with the tax construction stabilising and macroeconomic fundamentals being in strong well being, he stated. On condition that free commerce agreements with superior economies are on the playing cards, the federal government is eager to make sure that native trade doesn't face any constraints in scaling as much as reap the benefits of the accords. A revamp of the earnings tax legislation is already imminent with the invoice slated for the monsoon session.

A compensation cess is levied on some so-called sin items, together with cigarettes and cars, within the high 28% slab, launched to compensate states for any doable income loss because of GST transition for 5 years till June 2022. The cess was prolonged till March 31, 2026, to repay the curiosity and principal on the ₹2.69 lakh crore that the Centre had borrowed on behalf of states in the course of the Covid interval to fulfill the deficit within the cess fund.

A separate ministerial panel has been tasked by the GST Council to have a look at using the excess within the cess fund and the best way forward on that entrance.