No first info report has been registered as but and the enquiry is on the evaluation stage, the folks mentioned. A PE is performed to find out if a cognisable offence has occurred. An FIR is filed if an offence is prima facie established, or the case is closed for need of proof.

The Financial Offences Wing of the town police, which is dealing with the case, has recorded statements from staffers linked to a former chief monetary officer of the financial institution and members of the accounts division, the folks mentioned.

The financial institution didn't reply to ET's queries till press time Tuesday.

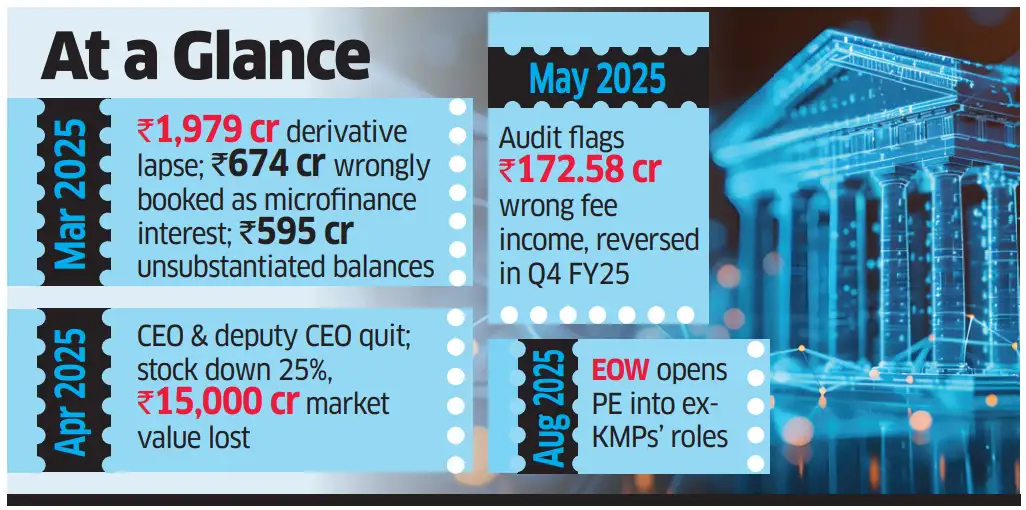

IndusInd Financial institution in March disclosed a ₹1,979 crore accounting lapse in its derivatives portfolio. An inside audit later discovered ₹674 crore wrongly booked as curiosity from the microfinance enterprise and ₹595 crore in “unsubstantiated balances” below “different belongings”.

In keeping with a senior police officer, the investigation is concentrated on two key questions: why notional earnings have been mirrored within the financial institution's steadiness sheet, and whether or not sure senior executives offloaded shares earlier than the lapses have been made public, making unlawful positive aspects. “If required, these former KMPs might be referred to as in for questioning,” the officer mentioned. A PE permits the police to summon folks linked to a case.

Whereas the Securities and Alternate Board of India can also be probing the matter for doable securities regulation violations, the police enquiry is over doable felony offences, together with wilfully inflicting a loss to the lender.

“The enquiry commenced after the financial institution wrote to us in regards to the alleged irregularities. The statements of these recorded to this point, together with key digital information, are being scrutinised,” the officer mentioned.

IndusInd Financial institution, India's sixth largest lender, is engaged on restoring investor confidence in it after the derivatives fiasco. Earlier this month, the Hinduja Group-promoted financial institution appointed veteran banker Rajiv Anand as its managing director and chief govt. His appointment adopted the sudden exits of CEO Sumant Kathpalia and deputy CEO Arun Khurana in April after the spinoff miscalculation got here to gentle, which led to a 25% slide within the financial institution's inventory value, eroding about ₹15,000 crore of its market worth.

The financial institution's inside audit division in Could submitted a report, which mentioned Rs. 172.58 crore was incorrectly recorded as charge revenue within the microfinance enterprise over the primary three quarters of fiscal 2025. These have been reversed within the fourth quarter ended March 31, 2025, the financial institution mentioned in an change submitting.