A Financial institution of Baroda examine pegged consumption associated to festivals, together with marriages, at ₹12-14 lakh crore within the quarter. Weddings expenditure alone is estimated at ₹4.5-5 lakh crore.

A weak labour market, low wages and 50% US tariffs on export sectors and MSMEs will stay a drag on the financial system, which grew at a five-quarter excessive 7.8% in April-June.

Economists anticipate development of about 7% within the second quarter, helped by a spending surge that started September 22, when decrease GST charges took impact. GDP numbers for July-September can be launched on November 28. The financial system grew 5.6% within the second quarter of FY25.

Rosy October

“City consumption, which had been on a weak footing since final yr, appears to have responded to the tax cuts,” stated Gaura Sengupta, chief economist at IDFC First Financial institution.

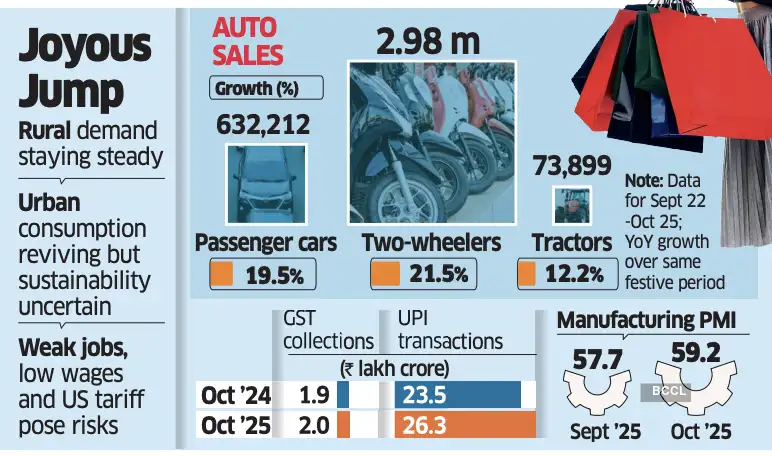

The third quarter began on a powerful observe, accessible information for October present.

GST collections rose 4.6% year-on-year in October to a five-month excessive of Rs 1.96 lakh crore. The HSBC Manufacturing Buying Managers' Index (PMI) climbed to 59.2 in October, supported by strong home demand after the GST cuts. UPI transactions in October rose 20.9% in quantity and 11.8% in worth from a yr earlier.

Financial institution credit score rose 11.5% from the yr earlier within the fortnight ended October 17, reflecting sturdy traction in the beginning of the festive season.

Trade estimates present that 470,000 vehicles, sedans and sports activities utility autos (SUVs) have been bought in October, marking a 17% improve from the year-earlier month.

The ready interval for client durables, resembling tv units, washing machines, and fridges has elevated amid the surge in demand. Retail and business executives stated it might take 45 days for provide and availability to return to regular ranges, ET reported earlier.

“The most important driver of financial development in Q3 can be client demand, pushed by the festive and wedding ceremony season,” stated Sakshi Gupta, principal economist at HDFC Financial institution.

Madan Sabnavis, chief economist at Financial institution of Baroda, stated that the marriage season in November-December will additional elevate spending, particularly on jewelry and clothes.

However Some Thorns

Efficient September 22, the GST Council launched a two-tier slab construction of 5% and 18%, which decreased costs on a number of home items, client durables and cars. ET reported earlier that GST cuts will enhance FY26 GDP development by 20-30 foundation factors.

Rural demand continues to anchor India's development, with economists assured about its sturdiness. Nonetheless, they struck a observe of warning on city demand, which has been comparatively weak attributable to slower wage development since FY25.

“The GST cuts have offered much-needed optimistic help to home demand,” stated Sengupta. “The true check of the restoration can be to see if the pick-up in city consumption sustains into This autumn FY26, past the competition season.”

Sabnavis stated jobs and better wages are crucial for sustaining consumption momentum.

Gupta stated US tariffs and a worldwide development slowdown might weigh on providers exports and, in flip, hiring. Nonetheless, tariff-related uncertainties and rising prices overseas might additionally profit India's providers sector, if offshoring inside world functionality centres will increase, she stated.