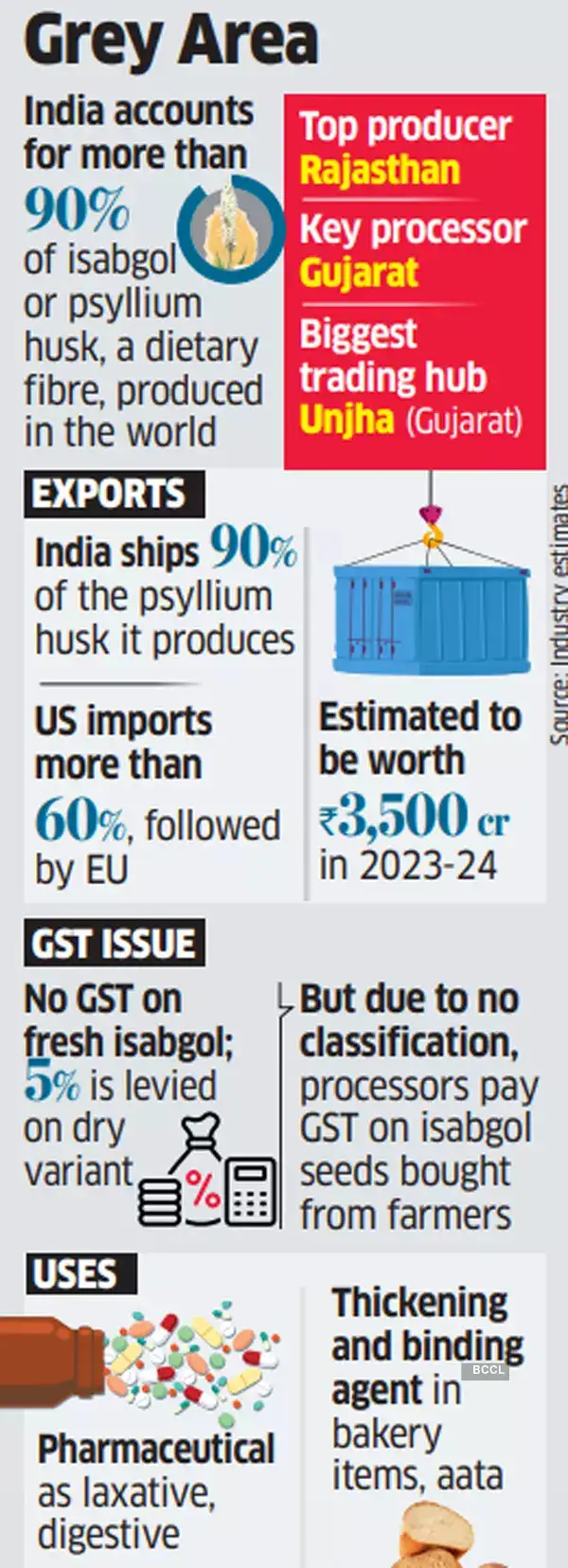

The business, which exports psyllium husk value greater than Rs 3,500 crore every year, primarily to the US, needs the federal government to cease accumulating GST on isabgol seeds, which ends up in locking up of their capital for longer than a yr. The All India Isabgol Processors Affiliation (IPA) has introduced that it's going to cease buying isabgol seeds from farmers from October 6.

The business leaders mentioned there's an ambiguity within the GST regulation, which the federal government had promised to take away throughout the current reforms. In keeping with an business veteran, the worth added tax (VAT) of the sooner oblique taxation regime was not relevant to isabgol. Nonetheless, it was introduced beneath the GST regime which changed VAT in 2016. Isabgol processors are compelled to pay GST on the seeds bought from farmers because of the lack of readability within the regulation, mentioned exporters.

They're additionally dealing with elevated monetary stress at a time when the tariffs introduced by Donald Trump have slowed down exports. The US accounts for about 60-70% of India's whole isabgol exports.

Exports in Sluggish Lane

“There is no such thing as a GST on contemporary isabgol and 5% GST is imposed on dry isabgol. Nonetheless, as there isn't a clarification concerning the classification of contemporary and dry isabgol, the business has been paying GST on the isabgol seeds bought from the market to keep away from being questioned by the GST authorities,” mentioned Rakesh Patel, accomplice, Sarvoday Sat Isabgol from Gujarat.“We've been approaching the GST division, the GST Council and different authorities for clarification since 2017. The federal government understands that as they don't get any income from the GST on isabgol, it's refunded. Nonetheless, this extended uncertainty over the difficulty has been blocking large quantities of our funds in GST, creating monetary stress for processors,” mentioned Ashwin Nayak, president, IPA.“Our exports have slowed down as patrons are placing the orders on maintain or suspending them,” he added. The processors separate the husk from the isabgol seeds, which is then offered to the meals and pharma firms. The remaining product is offered as cattle feed, which attracts no GST.

In keeping with IPA, Rajasthan produces 70% of the isabgol crop, whereas Gujarat processes about 70% of India's whole manufacturing. Unjha in Gujarat is its greatest buying and selling hub, accounting for greater than 80% of whole commerce.