Most of those individuals served with the notices for the monetary 12 months 2023-24 are understood to have proven these earnings as ‘exempt revenue' of their I-T returns as is allowed below rules.

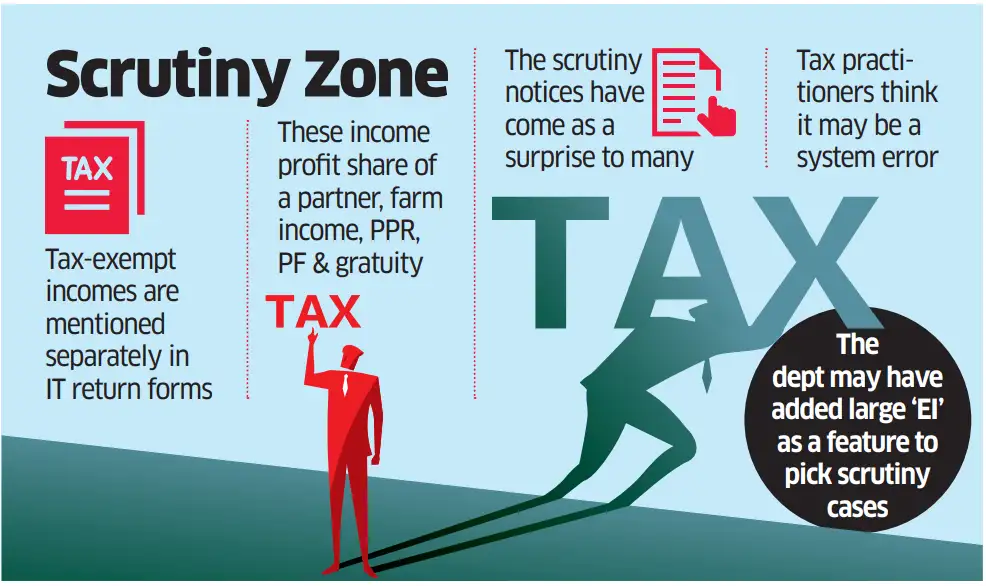

Tax-exempt revenue (EI) might be of various sorts: income shared by a agency to companions, agricultural revenue, disbursement of retirement advantages like provident fund and gratuity, the government-backed funding scheme like public provident fund (PPF) amongst others. Whereas submitting the ITR type, these are talked about below Schedule EI of the ITR type in order that such incomes are excluded from the computation of whole revenue below Part 10 of the I-T Act, 1961.

Over the previous one 12 months, the tax workplace has been going after people who've fraudulently proven giant quantities as farm revenue, or claimed advantages from bogus donations to little recognized political events and pretend lease receipts. However what stunned many is the present transfer to look at the veracity of receipts like partnership income and full and closing settlement quantities of retirees. Since a agency pays the tax, the income distributed subsequently are usually not taxed within the arms of the companions. A few of the tax practitioners really feel it might effectively be a system error which the I-T division wants to repair.

“Apart from the obligatory choice standards for scrutiny of ITRs, returns are additionally picked up primarily based on sure danger parameters framed by the division. This 12 months, claims of enormous quantities of exemption appears to have been one of many standards for choice for scrutiny. Many companions of enormous skilled partnership companies essentially obtain a share of revenue from the agency which is exempt, because the remuneration paid by a agency to its companions can't exceed 60% of its income. Equally, retiring workers obtain gratuity and PF, which is exempt from tax as much as sure limits. Many of those circumstances have additionally been picked up for scrutiny primarily based on this new parameter. From the return, it's evident that the individual is a companion of the agency or is claiming retirement advantages as exempt. Maybe, software of slightly little bit of vetting or thought course of might have helped keep away from useless scrutiny of such real circumstances of declare of exemption,” mentioned Gautam Nayak, a senior tax skilled and companion of the CA agency CNK & Associates LLP.

The scrutiny notices are issued slightly over a 12 months after the tip of the monetary 12 months below evaluate. The present set of notices, asking for a string of knowledge like sources of revenue and paperwork to assist the EI, had been issued since mid-August.In keeping with Ashish Karundia, founding father of the CA agency Ashish Karundia & Co, the intent behind Schedule EI is to advertise transparency and facilitate complete disclosure of such exempt revenue, and to not type the idea for initiating the scrutiny proceedings. “On condition that a lot of this data is already obtainable with the tax division, initiating scrutiny solely primarily based on disclosures made below Schedule EI, significantly below the class of ‘different exempt revenue', might not align with the legislative framework. Such an method dangers putting an avoidable compliance burden on taxpayers who've reported their exempt revenue precisely and in accordance with the regulation.” mentioned Karundia.

Taxpayers who escape scrutiny notices (issued below part 143) might uncover later that ‘reassessment proceedings' (below part 148) have been initiated in opposition to them. The division has an extended timeframe in issuing reassessment notices, significantly if the escaped revenue is greater than ₹50 lakh.

ET Bureau

ET Bureau“It is important that no antagonistic inferences are drawn merely from the reporting of exempt revenue on this schedule the place its exempt standing is clearly supported. Equally necessary is that any questionnaires issued to taxpayers as a part of scrutiny proceedings be related, particular, and appropriately tailor-made to the details of the case. This might be in line with the steering issued by the Central Board of Direct Taxes (CBDT) earlier this 12 months, aiming to make sure that inquiries stay centered and proportionate,” mentioned Karundia.

Whereas most grappling with the scrutiny notices would most likely be capable of defend their claims, they must nonetheless undergo the rigmarole of coping with the division.