Internet FDI was $616 million in outflows in August in contrast with $5 billion inflows in July, in accordance with information from the Reserve financial institution of India's newest month-to-month bulletin.

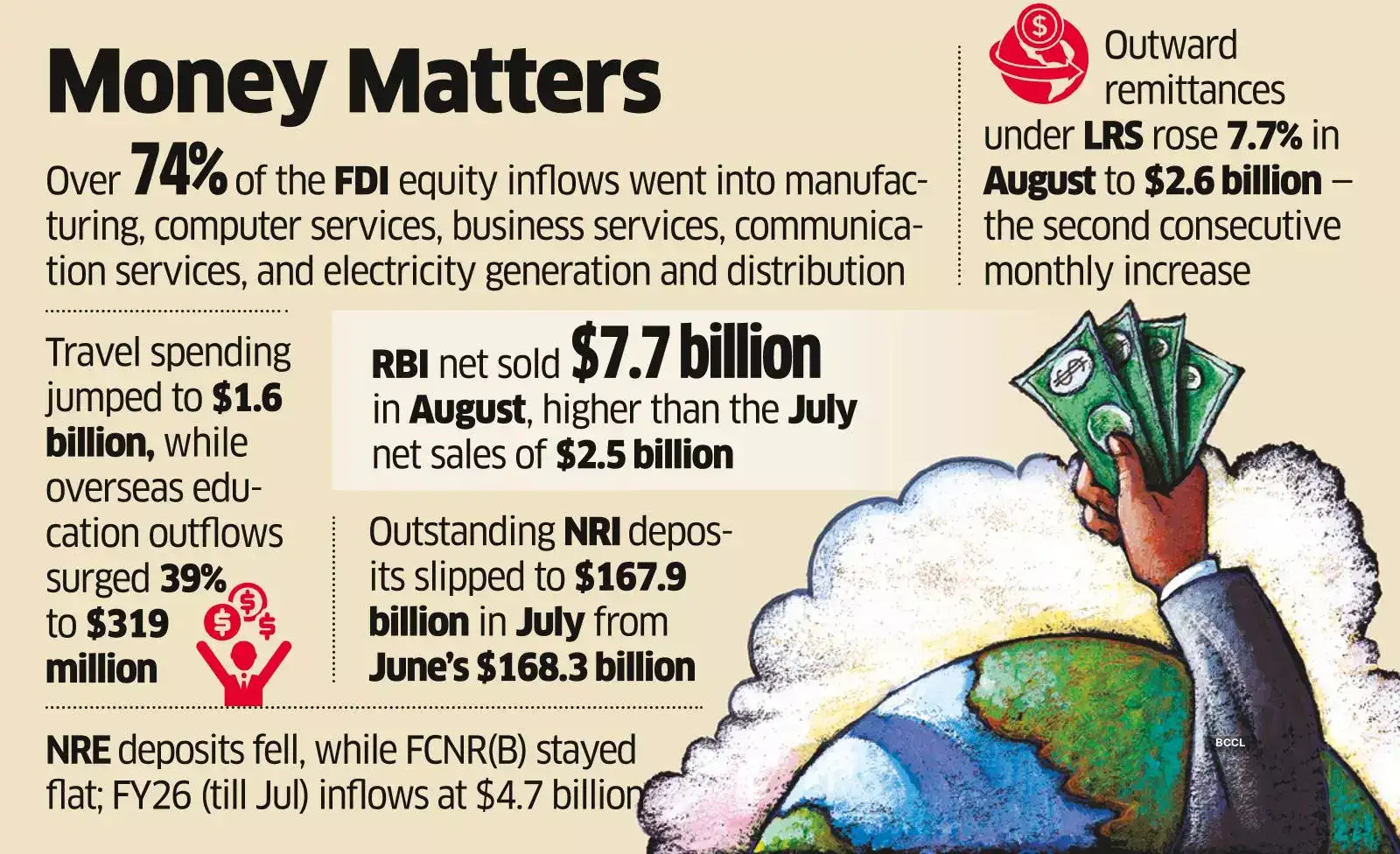

Singapore, the US, Mauritius, the UAE and the Netherlands had been the highest sources of FDI in April-July 2025, accounting for 76% of complete inflows, the RBI stated. Greater than 74% of the FDI fairness inflows had been in sectors like manufacturing, pc companies, enterprise companies, communication companies and electrical energy technology and distribution.

FINANCE $ SALES & REER

The RBI stepped up its intervention within the foreign exchange market, prone to comprise volatility and a steep fall within the Indian rupee towards the greenback. The central financial institution internet bought $7.7 billion in August, increased than the July internet gross sales of $2.5 billion, the most recent bulletin confirmed Monday. The rupee had breached the essential mark of 88 to a greenback for the primary time in late August amid US tariffs uncertainties.

The actual efficient change charge (REER) – the weighted common of India' s forex in relation to a basket of six main currencies – was 95.84 in September. This implies the rupee was undervalued by 4.16% relative to its intrinsic worth.

FINANCE REMITTANCESOutward remittances underneath the Liberalised Remittance Scheme (LRS) rose for the second time in a row in August. It stood at $2.6 billion, up 7.7% over July.Expenditure associated to journey, the biggest part of LRS, elevated to $1.6 billion in August from $1.4 billion a month earlier. Expenditure on abroad training elevated 39% month-on-month to $319 million in August.

Elements like buy of properties, investments in fairness & debt, and presents declined over the earlier month. The RBI's LRS permits resident people to remit funds overseas for particular present and capital account transactions, topic to an annual restrict of $250,000 per particular person.

NRI DEPOSITS

Excellent NRI deposits stood at $167.9 billion in July in contrast with $168.3 billion within the earlier month. Of those, FCNR(B) deposits remained flat at $33.6 billion in July, whereas non-resident (exterior) rupee account or NRE deposits fell to $102 billion from $102.8 billion in June. Flows from NRI deposits within the first 4 month of the monetary yr stood at $4.7 billion in contrast with $5.8 billion in the identical interval yr earlier.