Specialists mentioned this boosted probabilities of an rate of interest lower on the December financial coverage assembly, though this additionally is dependent upon components akin to financial progress and the conclusion of a commerce cope with the US.

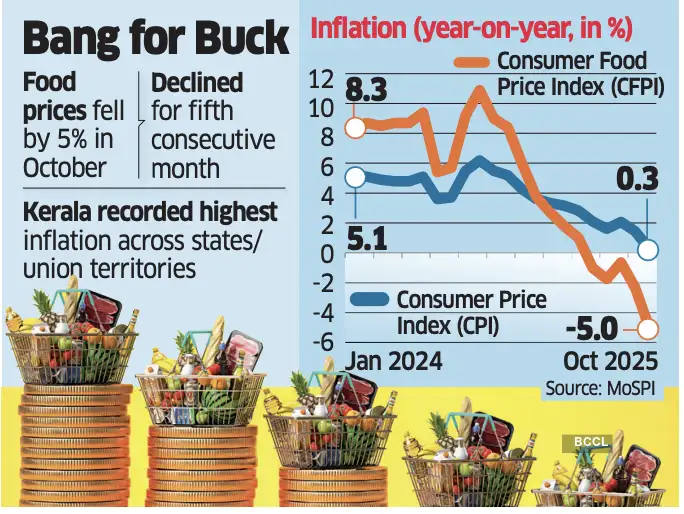

This marks the third time in FY26 that inflation has stayed beneath the central financial institution's goal vary of 4% with a margin of two share factors on both facet of that determine. Inflation based mostly on the Shopper Worth Index (CPI) was 1.4% in September and 6.2% in October 2024.

“The constructive affect of the GST rationalisation and deflation within the meals and drinks class supported the decrease inflation print,” mentioned Rajani Sinha, chief economist at CareEdge Rankings.

An in depth name

A two-slab GST construction took impact September 22, decreasing tax charges on varied home items and client durables.

Meals costs declined for the fifth consecutive month, falling 5% year-on-year in contrast with a decline 2.3% in September.

Final month, the Reserve Financial institution of India's Financial Coverage Committee (MPC) saved the benchmark rate of interest regular at 5.5%.

Whereas decrease inflation together with the dovish tone of the October coverage doc would assist a 25 foundation level charge lower in December, upcoming second-quarter GDP, commerce and industrial exercise information shall be key, conserving the result an in depth name, mentioned Aditi Nayar, chief economist at ICRA.

“Primarily based on the development of financial progress, the rationale for financial easing will not be very robust,” mentioned Paras Jasrai, affiliate director at India Rankings and Analysis (Ind-Ra). “Nonetheless, to stop the economic system going deep in sluggish and weak financial progress, the RBI might go for a 25-50 bps lower in repo charge in its December assembly.”

Gaura Sengupta, chief economist at IDFC First Financial institution, mentioned the MPC's resolution will depend upon progress situations and commerce outcomes.

“If India doesn't safe a commerce cope with the US, charge cuts are seemingly, in any other case, the RBI might keep on pause,” she mentioned.

Rural inflation fell by 0.25% year-on-year in October from 1.1% within the month earlier than, whereas city inflation eased to 0.9% from 1.8%.

Out of twenty-two main states and Union Territories, 9 reported greater inflation than the nationwide common. Kerala led with 8.6%, adopted by Jammu and Kashmir (2.9%), Karnataka (2.3%), Punjab (1.8%), and Tamil Nadu (1.3%).

Meals, core

Vegetable and pulses costs fell by 27.6% and 16.2%, respectively, in October. Amongst key gadgets, onions turned cheaper by 54.3%, potatoes by 36.7% and tomatoes by 42.9%.

Inside the meals basket, oil and fat recorded the best inflation of 11.2%.

“Double-digit inflation within the edible oil basket stays a key monitorable, notably as world vegetable oil costs keep elevated,” Sinha mentioned.

Core inflation, which excludes meals and power, stood at 4.4% with the affect of GST cuts offset by surging valuable steel costs. Gold costs rose 57.8 and silver 62.4%.

“By November, the affect of GST rationalisation ought to be extra seen on core inflation,” mentioned Madan Sabnavis, chief economist at Financial institution of Baroda.

The miscellaneous class recorded 5.7% inflation, led by private care and results at 23.9%.

ICRA expects inflation above 1% in November, whereas IDFC First Financial institution forecasts 0.6%. “The expectation is reflecting declining meals costs and continued cross by way of of GST cuts,” mentioned Sengupta.