Firms together with Indian Oil Corp., Bharat Petroleum Corp. and Hindustan Petroleum Corp. plan to skip spot purchases of the crude within the upcoming shopping for cycle, till there's clear authorities steering, stated the folks, who requested to not be recognized as they aren't licensed to talk publicly. That may have an effect on shopping for of the Russia's Urals cargoes for October-loading, they added.

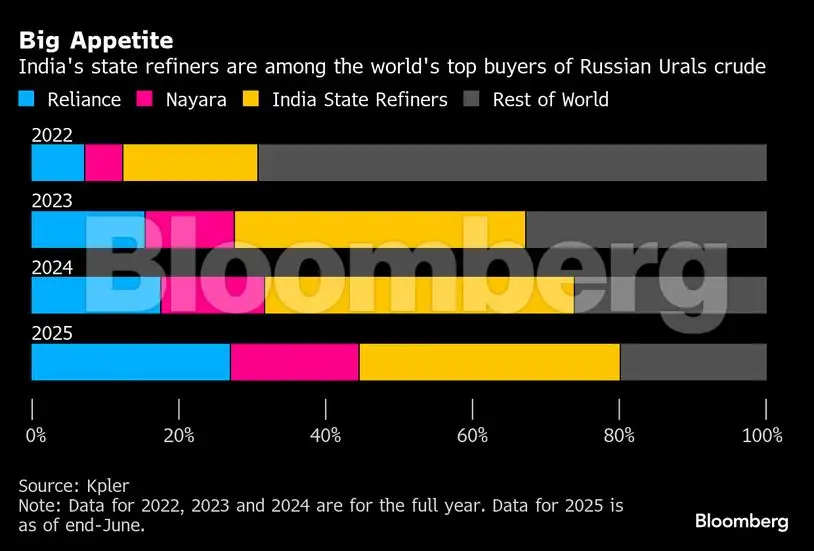

The worldwide oil market has zeroed in on India's crude buying after President Donald Trump doubled the levy on all Indian exports to the US as a direct punishment for the nation's refiners taking Russian crude. The escalation — which hasn't but been matched by related motion towards China, one other main purchaser — is supposed to stress on Moscow to finish the struggle in Ukraine.

The stress has swung futures this week as merchants assess the percentages of disruption to flows, in addition to Moscow's capability to search out various patrons ought to Indian refiners choose to take fewer barrels. Brent was little modified close to $67 a barrel on Thursday, following a five-day drop.

Formally, New Delhi hasn't given any route to refiners to cease shopping for Moscow's crude, with Prime Minister Narendra Modi's authorities pushing again towards Trump's tariffs. Bloomberg earlier reported that refiners had been requested to attract up plans for purchasing non-Russian crude.

Bloomberg

BloombergAn oil ministry spokesman didn't instantly reply to an e mail searching for remark. Individually, IOC, BPCL and HPCL didn't reply to messages from Bloomberg searching for remark.

Past time period contracts, oil producers and refiners usually take care of purchases in short-run cycles, with cargoes booked about one-and-a-half to 2 months forward of loading. That planned-ahead sample permits customers to make sure they've sufficient available to satisfy their necessities.

Whereas general purchases of October-loading Urals by India's refiners are unlikely to drop to zero, a dip might immediate a rush for different grades, with US, Center Jap and African cargoes as alternate options, stated merchants, who purchase and promote throughout the area. Discussions for October cargoes haven't but began, although merchants foresee deeper Russian reductions and extra presents to China, which doesn't usually take a lot of the variability.

In late-July, purchases of September-loading Urals concluded with India taking fewer barrels attributable to expensive presents. Since then, state-owned refiners have issued a slew of tenders, absorbing spot cargoes from different areas. Personal processors Reliance Industries Ltd. and Nayara Vitality Ltd., in the meantime, have been quiet, with the latter grappling with a steep drop in run charges following sanctions imposed by the European Union.

Cargoes of Urals — Russia's benchmark crude grade from the west of the nation — for August- and September-loading are more likely to be delivered as deliberate, except New Delhi advises in any other case, the folks stated. In latest days, tankers have offloaded some cargoes at Indian ports, albeit with some slight delays. At its peak, India imported greater than 2 million barrels a day of Russian oil, up from virtually zero purchases earlier than the Ukraine struggle.

“There can be some operational disruptions for a interval, however the crude supply-demand would steadiness out,” stated R. Ramachandran, former director of refineries at Bharat Petroleum. If Russian provides are tougher, “Center East crudes — with the geographical benefits and a variety of high quality shall be a chief substitute, particularly from Saudi and Iraq,” he stated.