In line with an ET ballot of 14 economists, the Q1 GDP progress was projected between 6.3% and seven%, with a median estimate of 6.7%, broadly consistent with the Reserve Financial institution of India's (RBI) forecast of 6.5%. GDP had slipped to a 15-month low of 6.7% in the identical quarter final yr.

“Actual GDP or GDP at Fixed Costs in Q1 of FY 2025-26 is estimated at Rs 47.89 lakh crore, towards Rs 44.42 lakh crore in Q1 of FY 2024-25, registering a progress fee of seven.8%. Nominal GDP or GDP at Present Costs in Q1 of FY 2025-26 is estimated at Rs 86.05 lakh crore, towards Rs 79.08 lakh crore in Q1 of FY 2024-25, exhibiting a progress fee of 8.8%,” the official press launch said.

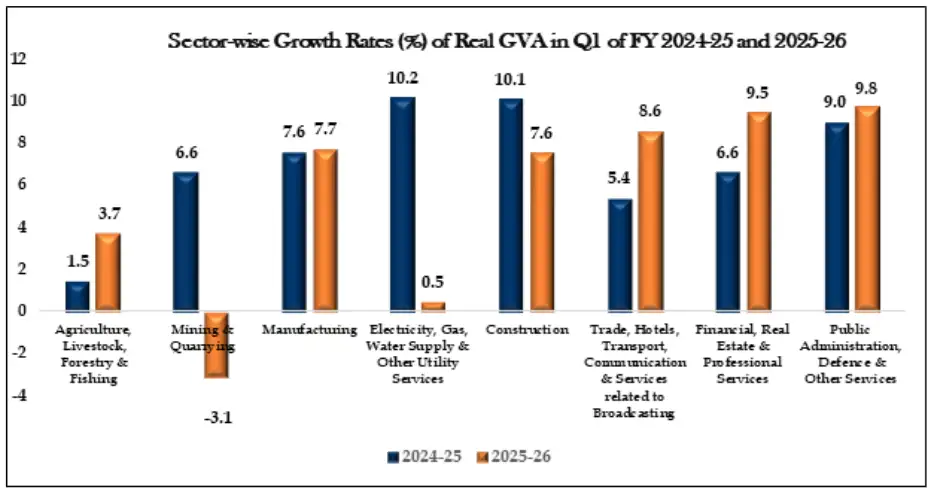

Sectoral classification

The first sectors comprising agriculture and mining industries witnessed 2.8% progress on an annual foundation as towards 2.2% within the corresponding interval of FY25.

Agriculture grew 3.7% within the first quarter of FY26 on an annual foundation. The sector had grown at 1.5% in Q1 FY25. The mining sector contracted 3.1% in Q1 FY26, towards a progress of 6.6% in FY25.

Additional, the secondary sector consisting of producing and electrical energy industries recorded a progress of seven% on an annual foundation. The expansion fee for India's secondary sector had stood at 8.6% in the identical interval of the final fiscal.Manufacturing witnessed a progress of seven.7% for the primary quarter of the present fiscal yr on an annual foundation. The manufacturing business had recorded a progress of seven.6% in FY25.

The tertiary sector progress stood at 9.3% yearly. Progress for commerce, resorts, transport, communications and providers associated to broadcasting grew 8.6% on an annual foundation in Q1 FY26, up from 5.4% in FY25.

In the meantime, monetary, actual property {and professional} providers witnessed a progress of 9.5% in June quarter as towards 6.6% in Q1 of the earlier fiscal.

Public administration and defence recorded a progress of 9.8% in Q1FY26 on an annual foundation towards 9% in FY25.

Public spending boosts progress

The Centre's capital expenditure rose by 52% year-on-year within the first quarter, rising as a key progress driver. Building and agriculture sectors carried out strongly, whereas aviation cargo visitors, GST assortment, and metal manufacturing additionally confirmed an uptick, an ET report mentioned.

“GDP progress is predicted to be supported by sturdy public spending, bettering rural demand and a resilient providers sector,” Rajani Sinha, chief economist, CareEdge Rankings, had mentioned.

Sakshi Gupta, principal economist at HDFC Financial institution, had added, “Building and agriculture are two sectors the place now we have accounted for larger progress. Exports of products and providers rose by 5.9% within the June quarter, aided by frontloaded demand from economies just like the US.”

All eyes will now be on how GDP progress pans out from right here with tariffs (authentic 25% plus extra 25%) in play. Economists anticipate that the possible GST rationalisation, RBI MPC-led rate of interest cuts and a beneficial monsoon would possibly assist consumption within the coming quarters.

However international commerce dangers stay. It could be famous right here that Trump's preliminary 25% tariff on Indian imports later went as much as as a lot as 50% after he imposed an extra levy linked to Russian oil commerce. Barclays economist Aastha Gudwani estimated this might shave off 30 foundation factors from India's full-year progress if the upper tariff charges persist.

“General, given the comparatively closed nature of the Indian financial system whereby home demand is the mainstay of progress, we don't see this 25% tariff menace impacting GDP progress meaningfully,” Gudwani added.

The World Financial institution and IMF have pegged India's progress at 6.3% and 6.4% respectively in FY26, protecting the nation among the many world's fastest-growing economies.