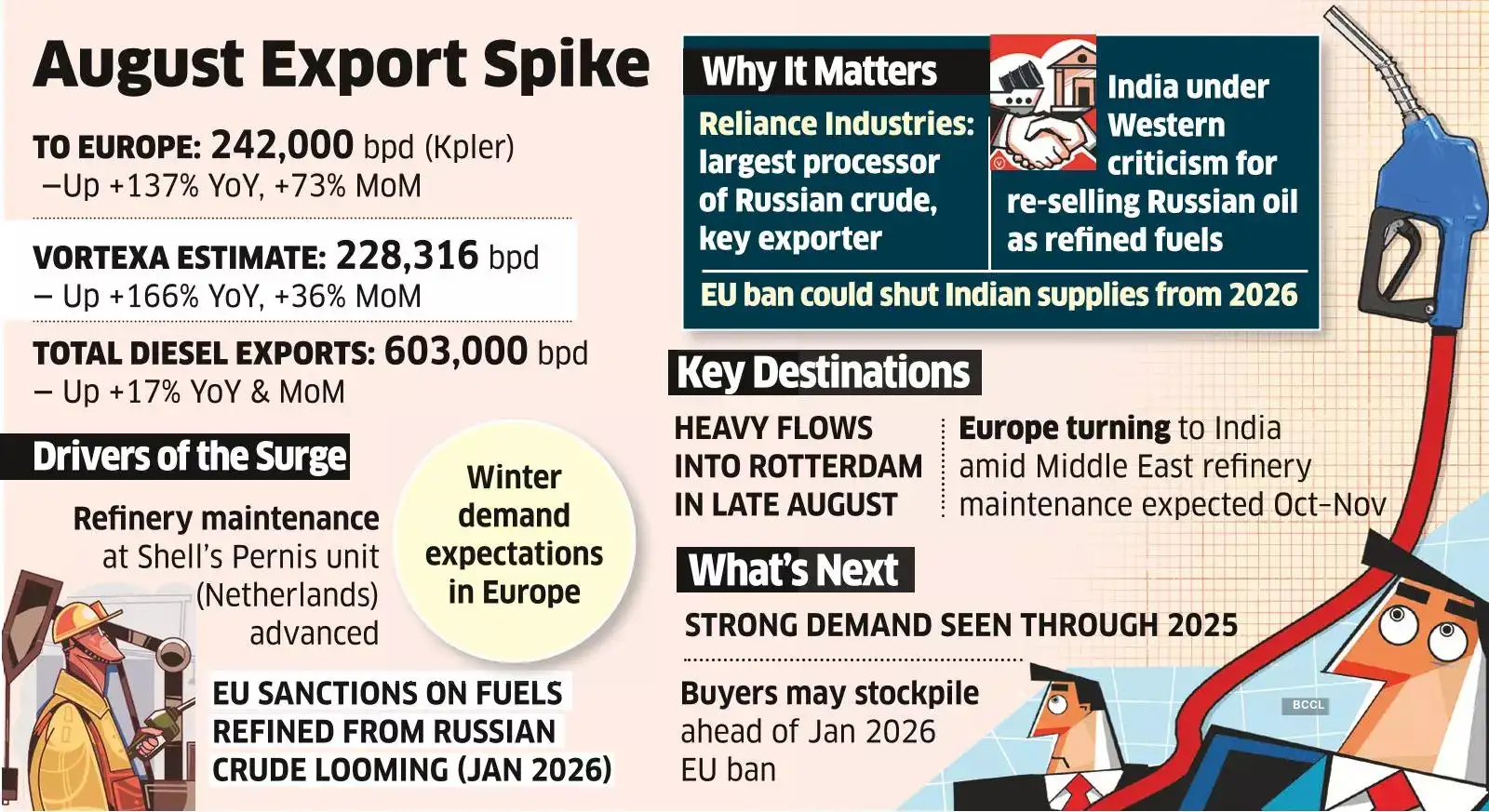

Analysts attributed the surge to a mixture of elements: a significant refinery's shock determination to advance upkeep, anticipated winter demand and looming EU sanctions that would shut Indian provides. They count on European demand for Indian diesel to stay sturdy by the remainder of 2025.

The late August push, significantly to Rotterdam, seems to be masking quantity misplaced because of surprising refinery upkeep, stated Sumit Ritolia, lead analysis analyst, refining and modelling at Kpler. “Exports rose sharply as Shell's Pernis (Netherlands) refinery superior its deliberate turnaround from 2026. This has stunned the market,” he stated.

An trade government stated that advancing upkeep may be preparation for the post-January market, when Indian fuels refined from Russian oil could not enter Europe.

India has in the meantime come beneath heavy criticism from senior US officers, who accused its refiners of profiteering by shopping for discounted Russian crude and reselling it after processing to the West, thereby funding Moscow's struggle machine. India has rejected this cost, arguing that the West can merely cease shopping for Indian fuels if it objects.

Indian exporters are anticipated to see continued sturdy demand from Europe this 12 months. “European consumers could speed up liftings from India provided that Center Jap refineries might be having a excessive upkeep in October-November, echoing the stockpiling seen forward of the February 2023 EU ban on Russian merchandise,” Ritola stated.

Europe counts Center Jap refiners as key suppliers.

Pushed by the surge in European shipments, India's whole diesel exports elevated to 603,000 bpd in August, up about 17% from each July and the year-ago interval, based on Kpler.

When saying sanctions in July, the EU stated importers must present proof of the nation of origin of the crude utilized in refining merchandise from third nations. Nevertheless, uncertainties stay round how the import curb might be carried out.