Indian corporations are scrambling to offset the ache from US tariffs and in search of workarounds to proceed servicing their American purchasers. Labor-intensive sectors like jewellery and attire are the toughest hit and US levies might scale back exports of sure items by as a lot as 90%, in accordance with a word from Bloomberg Economics this week.

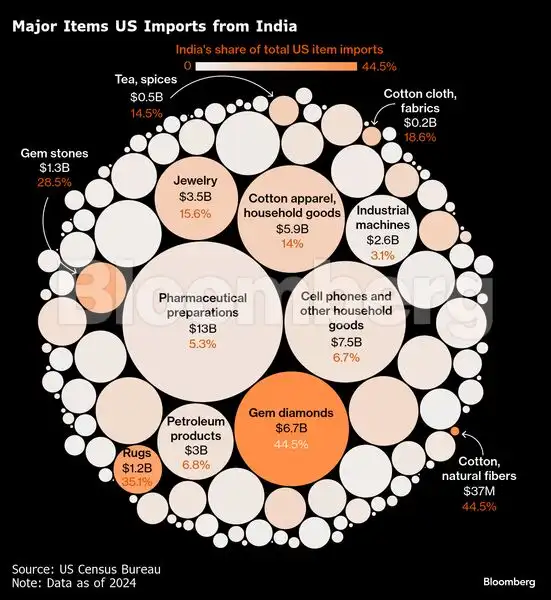

General exports from India to the US, its greatest market, might greater than halve after the upper tariffs that kicked in on Wednesday, it added. India exported greater than $20 billion of textile merchandise, jewellery and diamonds to the US in 2023.

“We'll proceed to develop in Africa in case of fifty% tariffs,” Gokaldas Exports's Managing Director Sivaramakrishnan Ganapathi stated in a cellphone interview, at the same time as he expects the tariff concern between US and India to quiet down quickly. The attire exporter has 4 factories in Kenya and one in Ethiopia. Each these nations face 10% US tariffs.

In the meantime, Raymond Life-style is negotiating with its American prospects to ship extra merchandise out of the corporate's Ethiopia plant to alleviate the tariff ache. “We are able to clearly shift among the purchasers to the Ethiopian manufacturing facility,” Chief Monetary Officer Amit Agarwal informed Bloomberg.

Dharmanandan Diamonds, a gems exporter primarily based in western Indian metropolis of Surat, will think about boosting manufacturing in Botswana if US continues with excessive tariffs, Reuters reported citing the corporate's Managing Director Hitesh Patel.

Bloomberg

BloombergViable Various

Africa has emerged as a viable various after Indian corporations begun exploring sweeter tariff spots abroad for servicing the US market. Some international locations within the continent — comparable to Ethiopia, Nigeria, Botswana, and Morocco — already give incentives comparable to tax holidays, other than customs obligation and VAT exemptions. Some are promising sector-specific initiatives and constructing particular financial zones to draw investments.

“African governments are providing compelling incentives comparable to tax breaks, land concessions, and regulatory facilitation to draw funding in manufacturing and expertise switch,” stated Soumya Bhowmick, a fellow at Observer Analysis Basis, including that the commerce developments have created a “distinctive arbitrage alternative.”

To make certain, any shift in manufacturing operations to the continent will probably be time consuming as Indian corporations have to renegotiate phrases with US consumers, at the same time as they see orders deferred or canceled.

Some US prospects are usually not very snug taking deliveries from Ethiopia fearing disruptions from potential conflicts, though labor prices are a couple of third of India's, in accordance with Agarwal.

That might change as India loses its aggressive benefit with these tariffs, he added.