Strict enforcement of the sanctions may upend international oil markets, probably eradicating 3.1 million barrels per day of Russian provide from worldwide commerce — a 3rd of which matches to India — and sending costs hovering as refiners in India, China, Turkey, and elsewhere scramble to safe December cargoes from a skinny international surplus, executives mentioned. Provide uncertainty and rising costs are set to dominate the trade, they mentioned.

Any entity doing enterprise with the sanctioned companies dangers secondary sanctions — a danger neither Indian refiners nor banks can afford as a consequence of their US publicity, executives famous.

The sanctions, introduced by the US Division of the Treasury's Workplace of International Property Management on Wednesday, mark Washington's renewed push to stress Moscow right into a peace cope with Ukraine.

Over $1b Dividends Trapped

The sanctions come after months of failed persuasion by US President Donald Trump. “I simply felt it was time. We waited a very long time,” he mentioned.

The measures additionally cowl Rosneft's upstream joint ventures Vankorneft and Taas-Yuryakh, the place Indian state companies collectively maintain 49.9% and 29.9% stakes, respectively.

Indian companions — ONGC, Oil India, BPCL, and Indian Oil — have already got over $1 billion in dividends from these ventures trapped in Russia that they're unable to repatriate.

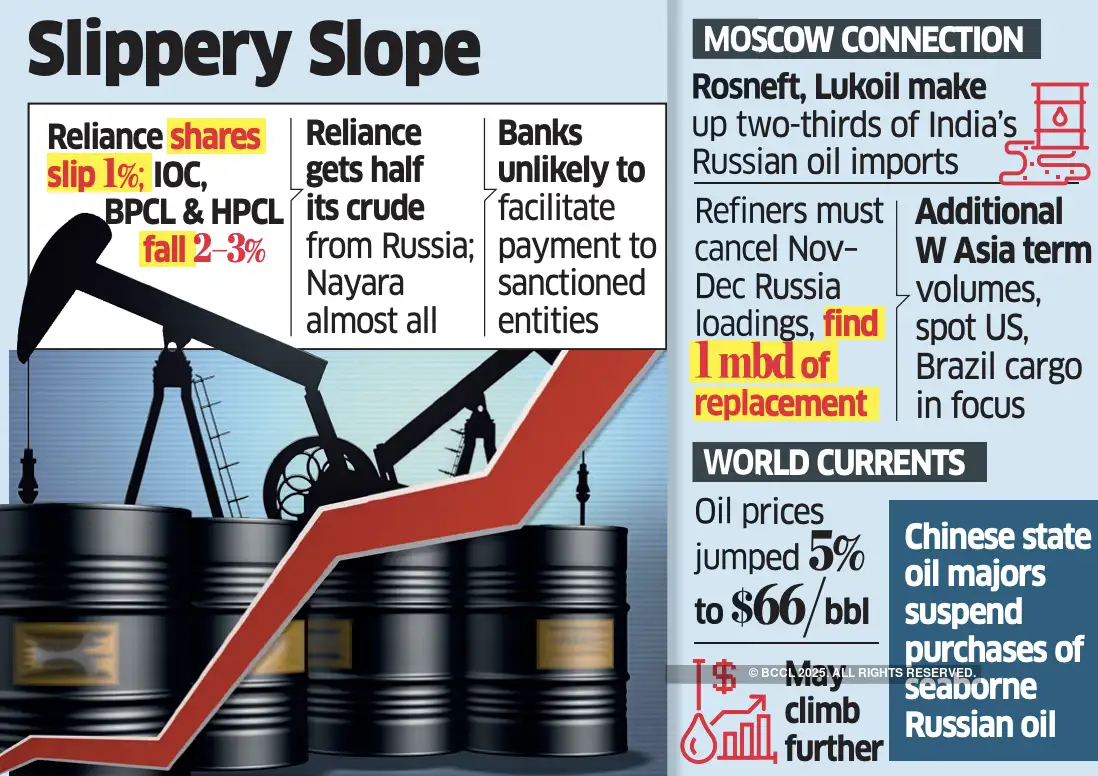

Reliance Industries shares fell 1% after an early rise on Thursday, whereas IOC, BPCL and HPCL closed 2–3% decrease because the lack of the Russian low cost (round $2 a barrel) and the necessity for costlier replacements weighed on refiners' shares.

“We are able to't cope with sanctioned entities,” a refinery govt mentioned.

EXPLORING OPTIONS

In line with the sanctions, firms worldwide should full all cargo receipts and funds by November 21. This successfully guidelines out recent loadings from Rosneft or Lukoil to India, as Russian shipments sometimes take a couple of month to succeed in India, executives mentioned.

Refiners will now must cancel November and December loadings and discover replacements for roughly 1 million barrels per day (mbd) of crude that Rosneft and Lukoil ship to India — about two-thirds of India's Russian imports.

They're exploring non-obligatory volumes beneath West Asia time period offers and spot cargoes from the US, Brazil, and elsewhere, executives mentioned.

“It may be costly, however we must always handle — Russia accounts for less than about 20% of our crude,” a state refiner govt mentioned, including that December imports shouldn't be considerably affected.

“Sanctions will damage however could not severely dent margins as oil stays within the $60s and crack spreads are enticing,” one other govt famous.

The affect might be a lot deeper for personal gamers Reliance Industries — which sources almost half its crude from Russia — and Nayara Power that relies upon completely on barrels from Moscow. Reliance buys most of its Russian provides straight from Rosneft beneath a time period deal, whereas state companies largely supply by merchants.

The most important roadblock is cost. “The funds won't undergo. Banks won't be able to facilitate these transactions,” an govt mentioned.

The dominance of the greenback, the popular forex for oil commerce, strengthens Washington's hand. Even when refiners try funds in yuan or UAE dirhams, greenback conversion is often concerned, giving the US Workplace of International Property Management visibility and management.

State-run refiners will even be affected, as even third-party cargoes of Rosneft or Lukoil origin may face cost refusals from banks. Rosneft and Lukoil collectively export round 3.1 mbd of Russia's 4.5–5 mbd whole crude shipments.

Indian refiners have come to depend on discounted Russian barrels for about one-third of whole crude imports, in contrast with nearly none earlier than the Ukraine warfare.