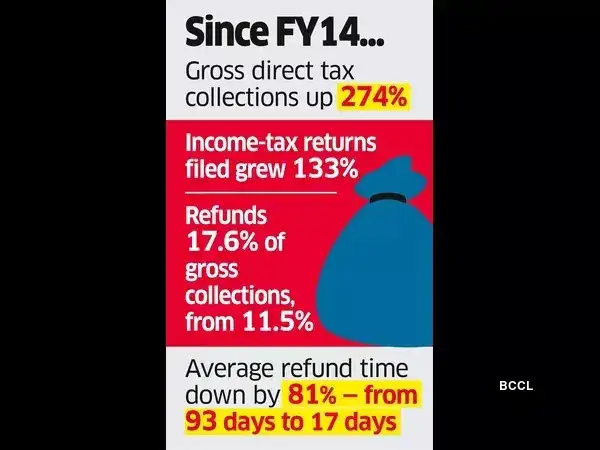

This 474% surge in 11 years outpaces the 274% development recorded in gross direct tax collections, which rose to ₹27 lakh crore in FY25 from ₹7.2 lakh crore in FY14. The variety of revenue tax returns filed additionally swelled by 133% to 88.9 million from 38 million.

Refunds as a proportion of gross direct taxes collected elevated to 17.6% in FY25 from 11.5% in FY14, reflecting elevated formalisation and voluntary participation within the tax system.

The tax division has additionally considerably decreased the time taken to subject refunds, with the common variety of days lowering by 81% to simply 17 days in 2024 from 93 days in 2013.

“It demonstrates that India's tax ecosystem is now firmly aligned with the rules of effectivity, transparency and taxpayer facilitation,” a authorities official stated. The official attributed this enchancment to the adoption of digital infrastructure, which permits quicker and extra correct processing of income-tax returns.The introduction of pre-filled returns, automation in refund processing, real-time tax deducted at supply (TDS) changes, and on-line grievance redress mechanisms have additionally contributed to decreased delays and improved taxpayer expertise, the official stated.