The Centre has despatched a proposal to the group of ministers arrange by the GST Council on the matter, suggesting that the 12% and 28% slabs be scrapped, leaving solely two vital charges — 5% and 18%.

The Centre expects the lack of GST income due to decrease charges to be made up by larger consumption.

The official stated the Centre is an equal companion in GST.

Fin Fee to Assess Impression

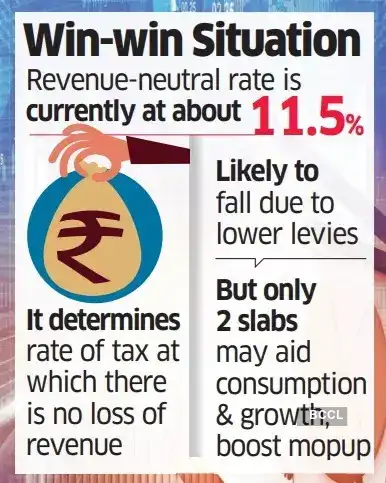

“What the Centre earns by taxes can also be shared with states by devolution,” the official stated. “The Finance Fee is there to take a look at any affect… however the income affect could be manageable.”It isn't Centre versus the states within the council, the official stated.The revenue-neutral charge — the speed of tax at which there is no such thing as a lack of income — is at the moment at about 11.5% and is more likely to fall additional.“Charge discount mathematically can deliver down income, however this train must be seen from its wider and deep financial affect that may carry consumption and development and in flip revenues,” the official stated.

The FY26 price range pegged gross GST income at Rs 11.8 lakh crore, a close to 11% improve from FY25. Collections had been 10.7% up at Rs 8.2 lakh crore within the April-July interval from a 12 months earlier. The Centre has budgeted a fiscal deficit of 4.4% of GDP in FY26 in contrast with 4.8% in FY25.