Officers advised ET the continued energy in GST collections demonstrates that the reforms are concurrently underpinning native consumption and income buoyancy for the federal government.

“We're broadly aligned with budgeted revenues. Any deviation might be modest,” a senior official advised ET. The GST reforms, efficient September 22, decreased the multi-layered tax construction to successfully two broad slabs of 5% and 18%, together with a particular 40% fee for choose gadgets. The official cited above added that the federal government strategically timed the implementation date of GST rationalisation with the festive season, serving to undergird home consumption.

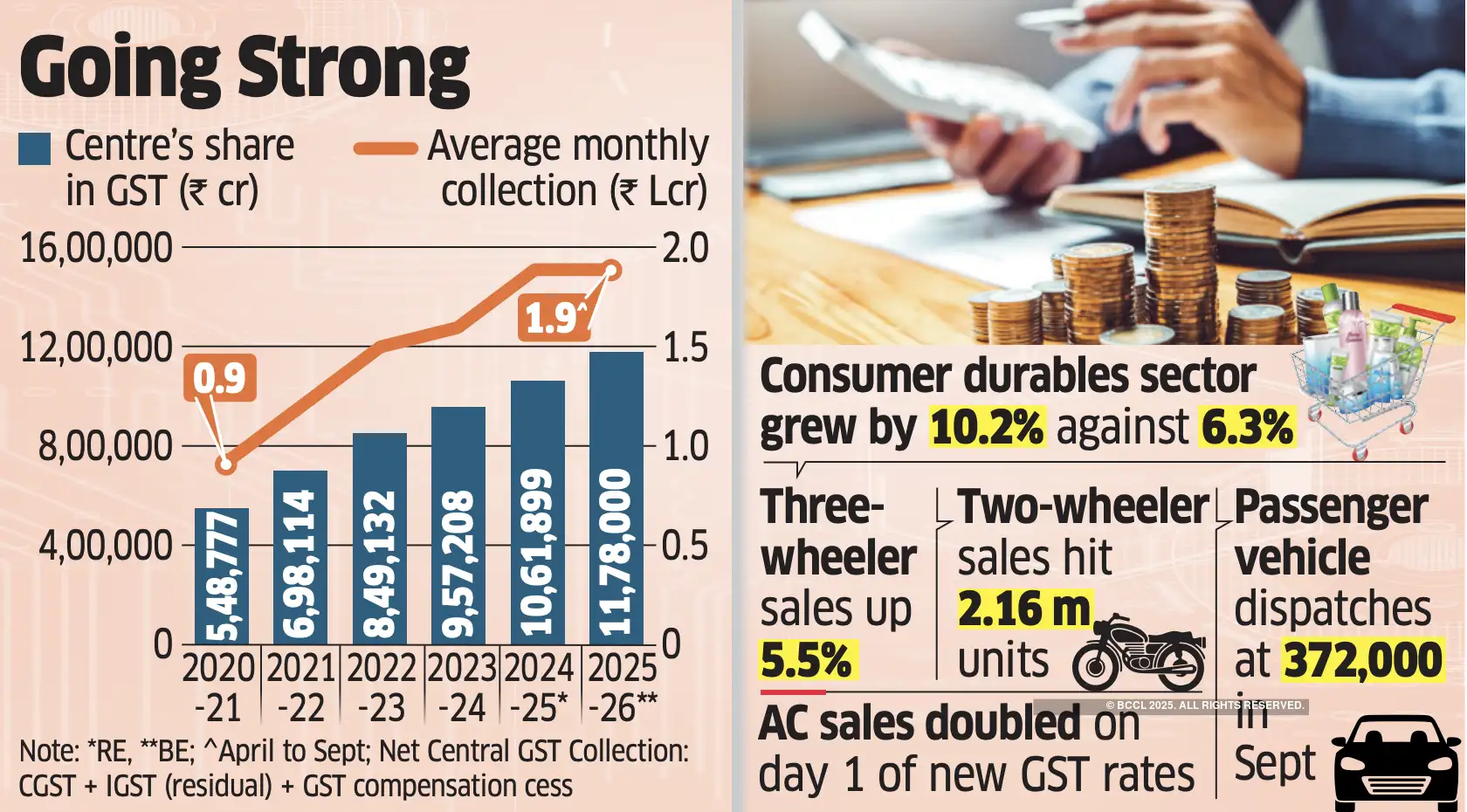

Three-wheeler dispatches elevated 5.5%, whereas two-wheeler gross sales reached 2.16 million items in September.

Wholesome Enterprise Exercise

Passenger car dispatches had been at 372,000 in September and air-conditioner gross sales doubled on the very first day the GST reforms kicked in. TV gross sales noticed a 30-35% enhance.

“The constructive takeaway is that demand has surged as meant, and income continues to be holding robust regardless of decrease tax incidence,” mentioned an official.The Centre collected Rs 1.89 lakh crore as GST in September, up 9.1% year-on-year. Going by the obtainable gross sales tendencies, the gathering momentum possible saved up in October as properly.“The robust GST collections throughout the festive season clearly present that individuals are spending and enterprise exercise stays wholesome,” mentioned Amit Maheshwari, Tax Associate, AKM International, a tax and consulting agency. October collections would even be strong, he mentioned.

Nevertheless, each the federal government and tax specialists imagine that collections might soften as soon as the festive season is over.

“Collections historically stay increased throughout pageant season and December numbers will mirror the right assortment pattern as soon as the euphoria of the festivals settles down,” mentioned the primary official cited above.

The official added that the shortfall won't be as excessive as “speculated” by specialists and economists and might be income impartial, compensated by increased than budgeted non-tax income.

Officers mentioned the precise quantum of the shortfall could also be accurately assessed solely after December, having analysed the post-festive GST assortment tendencies. Based mostly on that evaluation, the federal government might contemplate revising the finances estimates downward, if required.

The official added that the brand new GST registration and verification norms efficient from November 1, together with stricter authentication and bodily verification for high-risk circumstances, are more likely to plug income leakages and curb pretend billing practices.

Economists say the shortfall wouldn't impression total fiscal math.“Given increased than budgeted non-tax revenues, and financial savings that usually are typically present in expenditure relative to the finances estimates, we imagine the federal government might be able to follow its fiscal deficit goal of 4.4% of GDP,” mentioned Aditi Nayar, chief economist, ICRA.