The GST Council, the apex decision-making physique on the levy, is more likely to meet September 18-19 to take up the proposed adjustments, they mentioned.

Prime Minister Narendra Modi had highlighted the approaching adjustments in GST throughout his Independence Day handle on Friday, calling it a “Diwali reward” for the individuals of the nation.

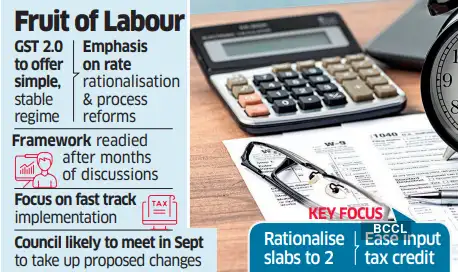

GST 2.0 will even scale back the tax burden by having solely two main slabs — 5% and 18%. “Fee rationalisation is one a part of the proposal, but it surely goes a lot past that… This is a chance for a wider reform of the construction,” one of many officers informed ET.

Divergent choices by varied courts on the taxation of the identical gadgets had given rise to ambiguity, he mentioned. Different challenges associated to inverted obligation buildings and enter tax credit score are being addressed by this train in a complete method, the individual mentioned.

“GST with a number of adjustments from time to time had grow to be a piece in progress,” one other official mentioned.

Particular levy for sin items

“The proposed train goals to revamp and simplify the construction in a holistic and complete method as a substitute of a piecemeal train,” official mentioned. The recast additionally goals to resolve classification disputes which have arisen because of completely different varieties of comparable items having been positioned in varied slabs. The official mentioned no differentiation can be made on account of divergent costs for a similar good as a precept.

Points associated as to whether a namkeen is extrusion-based or non-extrusion-based or whether or not a product is good or savoury — thus attracting completely different tax charges — is not going to come up following the adjustments. The Centre, in its proposal, has sought to scrap the 12% and 28% slabs, retaining solely the 5% and 18% charges. A lot of the gadgets of each day consumption, these utilized in farming or associated to well being are anticipated to be within the 5% bracket. A particular charge of 40% will likely be launched for about half-adozen gadgets that can embody so-called sin items and luxurious automobiles.

“We've examined every merchandise and points round it,” the second official mentioned. “The thought was to look forward and never the way it was performed previously, line by line… It was an intensive and rigorous train.”

The proposal has already been despatched to the group of ministers (GoM) that the GST Council had arrange on charge rationalisation. The panel will deliberate on the Centre's proposal within the coming week. The GoM's suggestions will likely be positioned earlier than the GST Council.

The Centre will maintain discussions with the states on the proposal, which has the potential to perk up home consumption and bolster development. Officers are hopeful that the timelines might be met to satisfy the festive season procuring date.