The states prompt imposing a levy on sin items along with the proposed 40% GST fee to take care of the present tax incidence, which must be distributed amongst states.

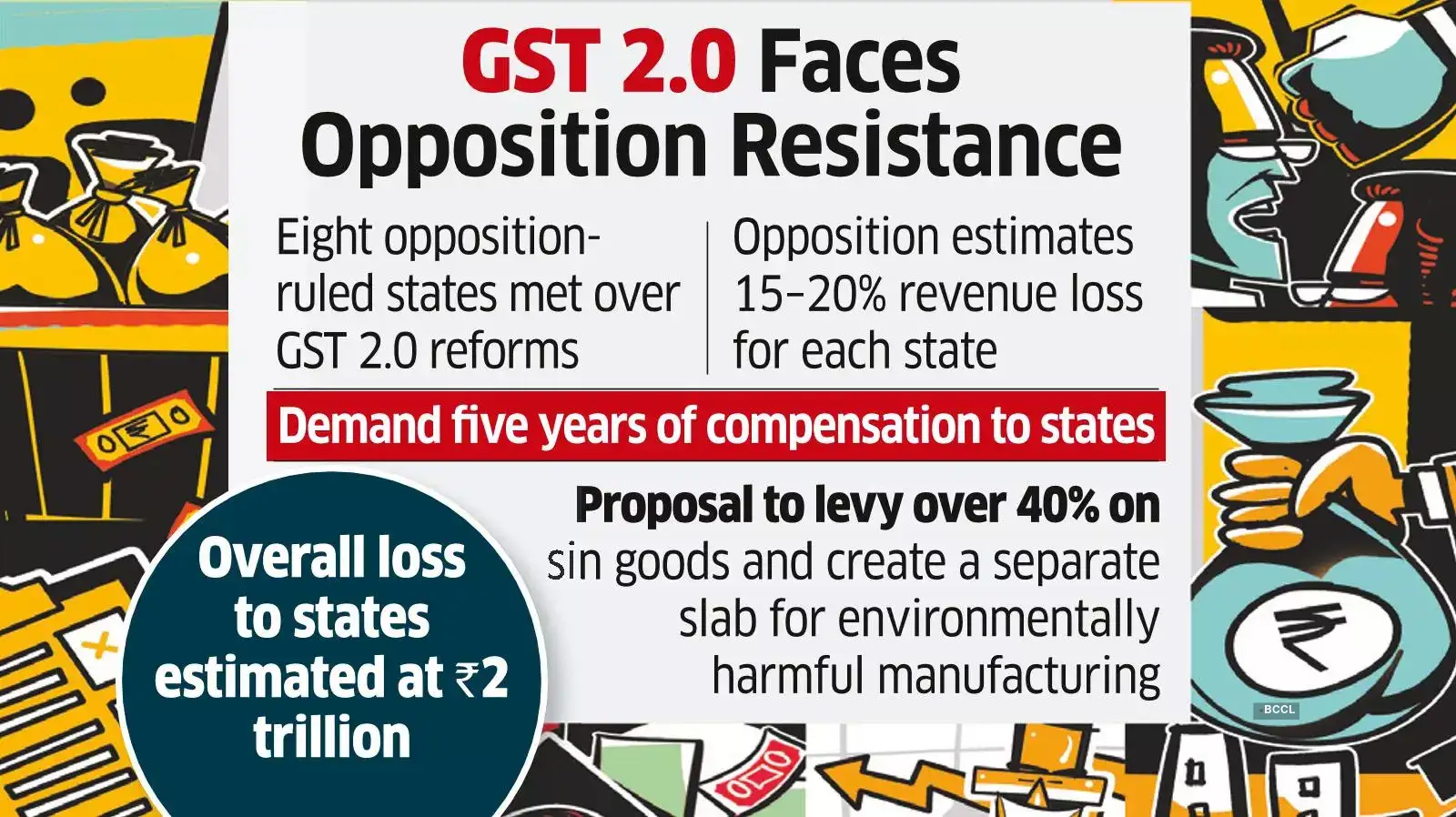

Finance ministers from Tamil Nadu, West Bengal, Karnataka, Telangana, Kerala, Punjab, Jharkhand and Himachal Pradesh met forward of the GST Council assembly scheduled on September 3-4.

The opposition-ruled states will meet once more On September 2 to finalise their calls for and options, earlier than presenting to the GST Council.

Karnataka finance minister Krishna Byre Gowda stated every state is predicted to lose 15%-20% GST income.

“The 20% GST income loss will severely destabilise the fiscal construction of state governments throughout the nation,” Gowda stated, dismissing the notion that tax income buoyancy will improve after the speed lower. He added that states must be compensated for 5 years or until the revenues stabilise.

Tamil Nadu finance minister Thangam Thennarasu additionally reiterated the demand, which was adopted by a submit by state chief minister MK Stalin on social media platform X.

“Whereas welcoming the intent of reform, we burdened that any discount should not erode State revenues that maintain welfare programmes and infrastructure. We urge that the advantages of decrease charges should immediately attain widespread individuals,” Stalin stated.

“A consensus draft has been framed and shall be positioned earlier than the GST Council, looking for help from all States and the Union authorities to safeguard income pursuits and guarantee truthful outcomes,” he stated, including that “with out defending State revenues, #GST reforms can not serve the individuals”.

The opposition-ruled states are in favour of GST rationalisation although they sought a mechanism to protect towards profiteering by companies and to make sure the advantages of fee rationalisation attain the widespread man. ET had reported it on August 27.

Different calls for got here from Himachal Pradesh technical schooling minister Rajesh Dharmani, who requested for “a separate slab for red-category manufacturing corporations which adversely impression the setting”.