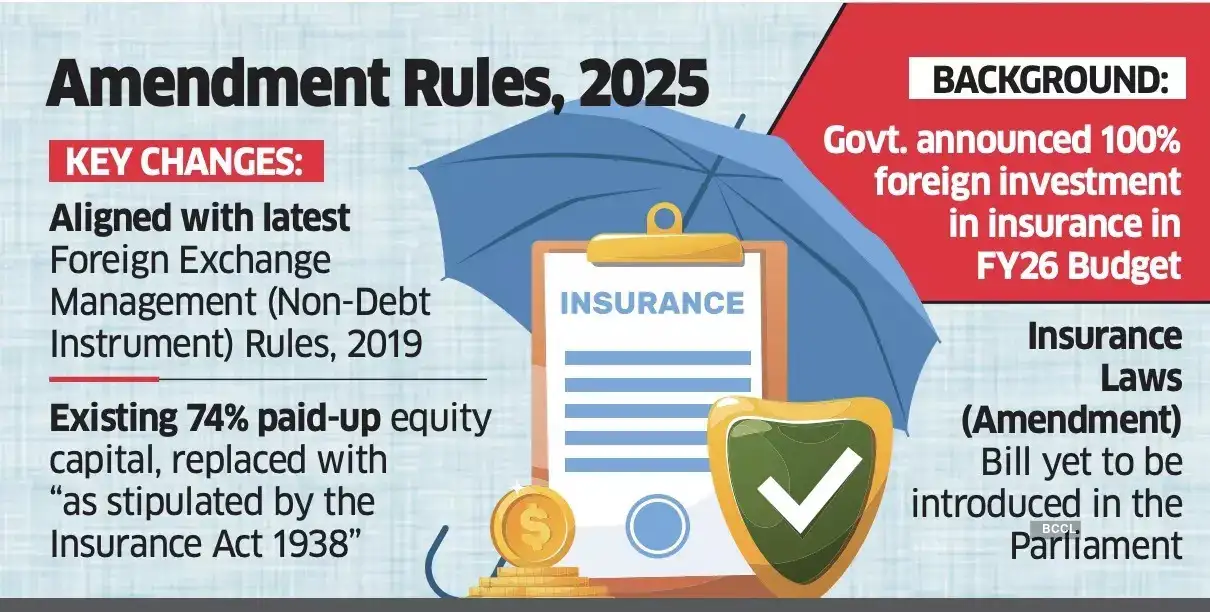

As per the notification, the Indian Insurance coverage Corporations (International Funding) Modification Guidelines, 2025, search to switch the prevailing restrict of 74% international funding with “as stipulated by the Insurance coverage Act, 1938”.

“Within the principal guidelines, in rule 3, the phrases ‘to exceed 74% of the paid-up fairness capital of such Indian insurance coverage firm' shall be substituted with the phrases ‘to exceed the restrict as stipulated by the Insurance coverage Act, 1938',” stated the notification issued on August 29.

“The international funding proposals of the Indian insurance coverage firm shall be allowed on the automated route for the paid-up fairness capital as stipulated by the Insurance coverage Act, 1938, topic to verification by the Insurance coverage Regulatory and Growth Authority of India,” the notification added.

Within the February finances, the Centre introduced that the FDI restrict for the insurance coverage sector can be raised from 74% to 100% and that the improved restrict can be solely allowed for corporations who make investments their complete premiums in India.

The federal government had additional famous that present guardrails and conditionalities related to FDI can be reviewed and simplified. In addition to easing international funding limits, the proposed Insurance coverage Legal guidelines (Modification) Invoice additionally has provisions for composite licences and permitting foreigners as key managerial personnel (KMP) in Indian insurance coverage corporations.The federal government is but to introduce the invoice within the parliament. Final month, finance minister Nirmala Sitharaman had stated in Lok Sabha that 100% FDI in insurance coverage will assist unlock the complete potential of the Indian insurance coverage sector and enhance insurance coverage protection.

“With the rise in international direct funding restrict from 74% to 100% for insurance coverage corporations, the federal government goals to unlock the complete potential of the Indian insurance coverage sector, which is projected to develop at 7.1% yearly over the following 5 years, outpacing world and rising market development,” she stated in a written reply in Lok Sabha.