Adjustments may embody enhanced consumer particulars, rapid alert for any change in ‘know your buyer' (KYC) for accounts red-flagged for suspicious transactions and a recent set of ‘alert indicators' for capital market, cash exchanges and bulk property or gems and jewelry purchases.

The transfer goals to make disclosures extra strong within the fintech and cryptocurrency area to stop suspicious transactions earlier than it's too late to trace.

“There's a want for enhancing the reporting requirement particularly in fintech area and crypto foreign money, the place imposing businesses face most challenges. We're discussing it with RBI and different regulators and can formally strategy them with a framework for detailed discussions,” a senior official informed ET.

In April, each FIU-IND and RBI signed a memorandum of understanding (MoU) for higher info alternate and efficient implementation of necessities of the Prevention of Cash Laundering Act and Guidelines.

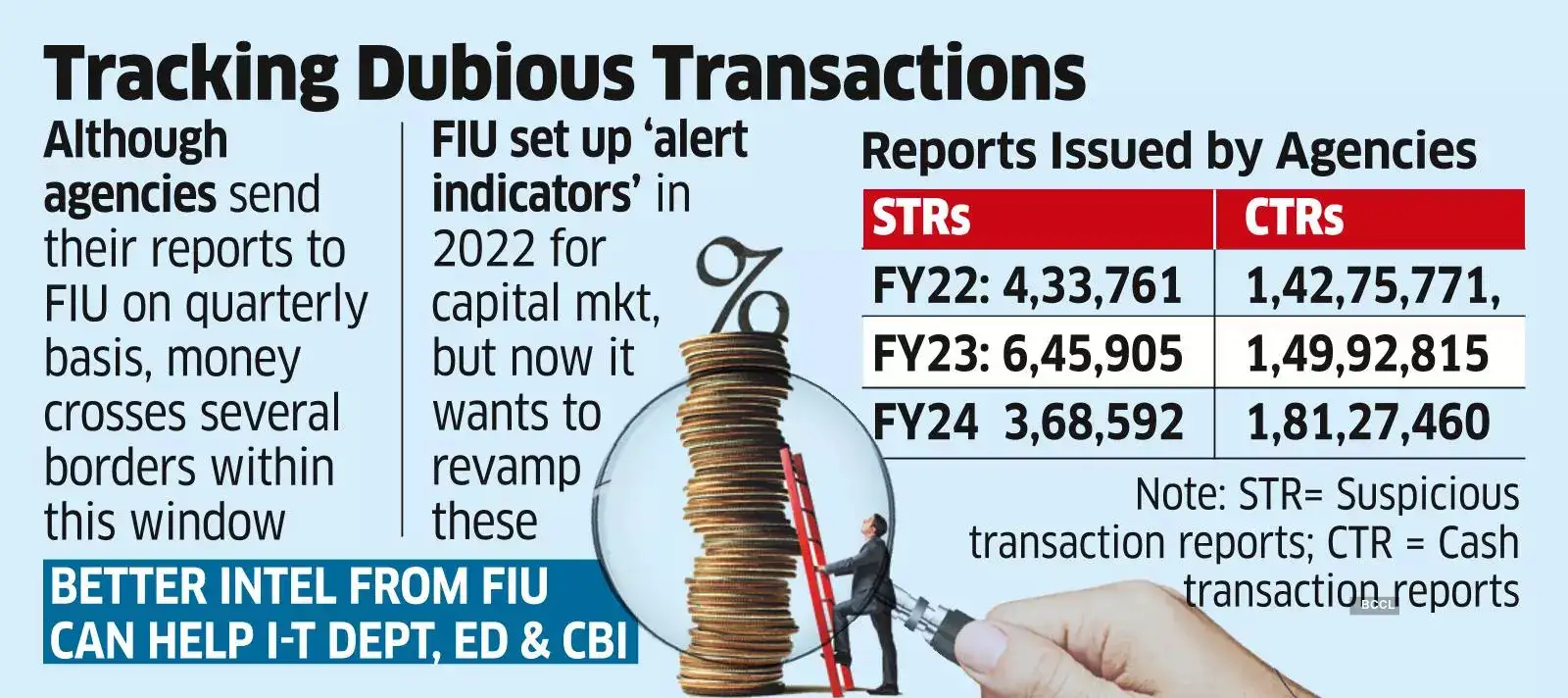

Whereas most of those reporting businesses ship their stories to the FIU on quarterly foundation with suspicious transaction stories, officers mentioned that by the point the report reaches, cash crosses a number of borders making it tough to get the path.

“The thought is that when a giant bulk switch or buy occurs, it should instantly ship an alert to the interior system in order that FIU may be instantly alerted, which makes it simpler to trace the transaction.

This may also assist FIU to generate significant intelligence for legislation enforcement businesses just like the earnings tax division, ED and CBI, the official mentioned.

FIU had launched the ‘alert indicators' in 2022 for the capital market, however it's felt that these must be revamped in view of technological modifications over time.

“The thought is to trace order spoofing, misutilisation of shopper funds by inventory brokers and suspicious off-market transactions by brokers and customers,” the official added.