Less complicated Slab Construction

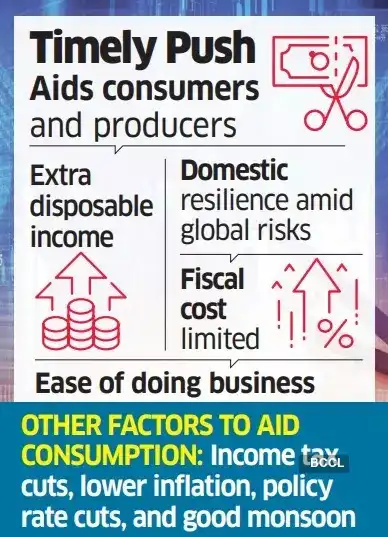

QuantEco Analysis economist Yuvika Singhal stated, “Any type of discount in taxes is optimistic for consumption because it leaves larger disposable revenue within the arms of shoppers.” Prime Minister Narendra Modi had stated in his Independence Day speech on Friday that GST reforms would offer reduction to micro, small, and medium enterprises (MSMEs), native distributors and shoppers.

The GST cuts on objects will vary from durables reminiscent of fridges and air conditioners to packaged meals and medical provides.

“It is a much-needed growth, and GST rationalisation is the necessity of the hour, aside from different reforms,” stated Paras Jasrai, affiliate director at India Scores and Analysis (Ind-Ra). The Centre has proposed that India transfer to a less complicated, two-slab construction from 4 currently–retaining the 5% and 18% charges and scrapping the 12% and 28% levies, ET reported earlier.

“With oblique taxes having a wider attain, GST reforms can ship a stronger increase,” stated Gaura Sengupta, chief economist at IDFC First Financial institution. “Rural consumption is bettering however not broad-based sufficient to offset weak city demand, so a fiscal push was wanted—and these reforms present that.”

Native vs International

Jasrai stated that decrease stabs and tax charges will give consumption demand a major increase, particularly amid the uncertainty over commerce tariffs which might be seen impacting exterior demand.US President Donald Trump has imposed a 50% tariff on India, together with a 25% penalty for importing Russian oil. The Worldwide Financial Fund (IMF) and World Financial institution have lower world progress forecasts amid the prevailing commerce uncertainty. Even so, India's home energy will stand out.“Since home consumption makes up a bigger share of the financial system, India will stay resilient regardless of world headwinds,” stated Singhal. A rise in spending exercise may also elevate gross home product (GDP). The increase to nominal GDP progress is estimated at 0.6 proportion level over 12 months utilizing fiscal multipliers, stated Sengupta.

HDFC Financial institution's Gupta stated the reform might increase demand for client durables if GST charges on objects reminiscent of ACs and TVs are diminished. “A extra notable impression is also seen for demand for two-wheelers and automobiles if the present GST charge of 28% is diminished to 18%,” she stated.

Singhal highlighted that fast-moving client items (FMCG) firms will see a optimistic impression, relying on how and when the modifications are carried out.