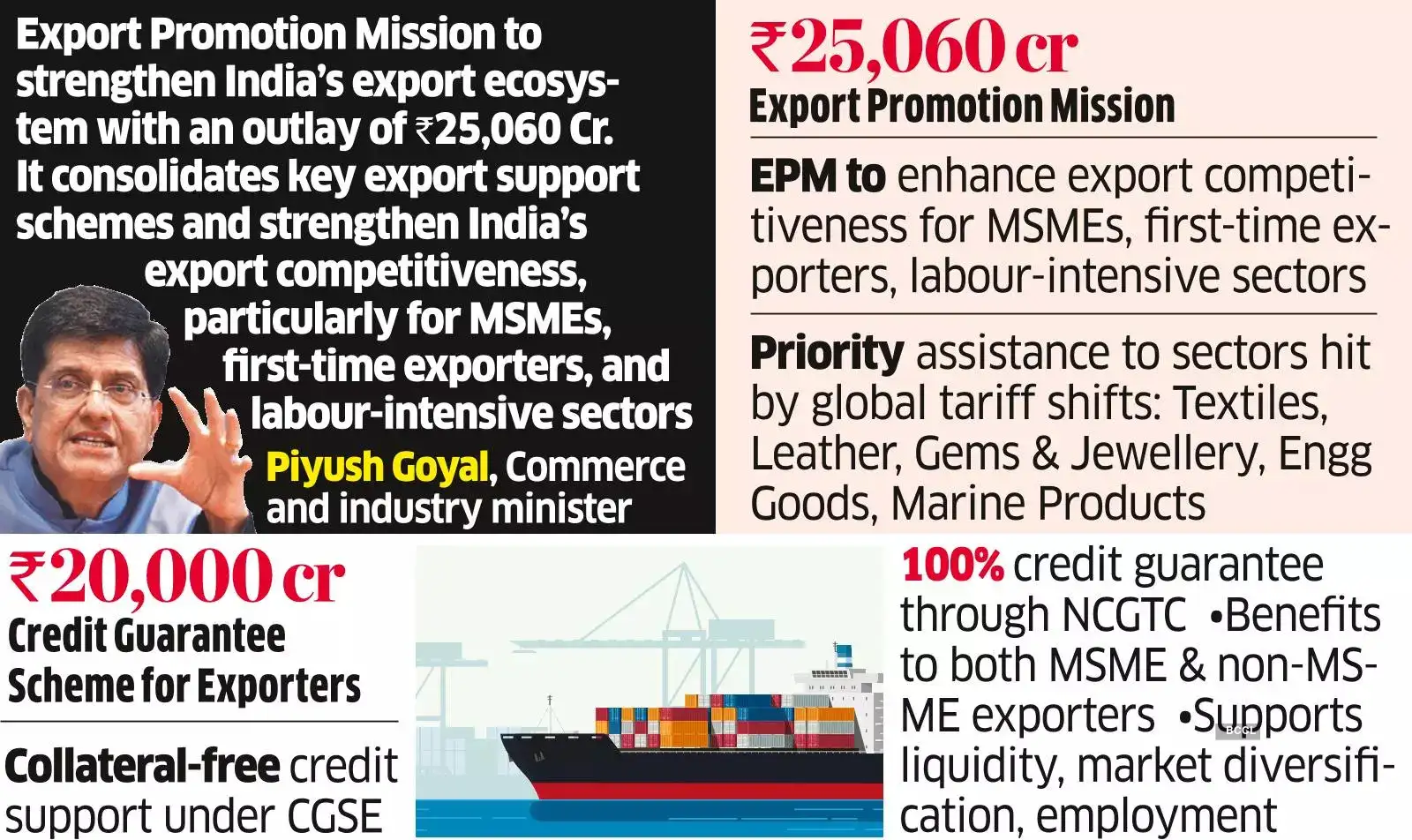

The package deal has two elements – a ₹25,060 crore Export Promotion Mission (EPM) that can run for six years and a ₹20,000 crore collateral-free Assure Scheme for Exporters.

India's exports are up 3% within the first half of the FY26 fiscal to $220 billion, using a 13.3% surge in shipments to the US as exporters rushed to beat the August 27 deadline when 50% tariffs kicked in.

US exports might fall sharply within the second half of FY26.

The EPM, introduced within the Union Finances 2025-26, seeks to strengthen India's export competitiveness, notably for MSMEs, first-time exporters, and labour-intensive sectors.

That is anticipated to assist goal an even bigger share in present markets and discover untapped ones to make up for the decline within the US market. India exported $48.2 billion value items to the US in FY25″It's a very complete mission and can help the whole export ecosystem,” stated Data and Broadcasting Minister Ashwini Vaishnaw.

The EPM can be applied via two sub-schemes ₹10,401 crore Niryat Protsahan and ₹14,659 crore Niryat Disha. The dual export help schemes will run for 5 years over FY26 to FY31.

It consolidates key export help schemes such because the Curiosity Equalisation Scheme and Market Entry Initiative, aligning them with modern commerce wants, in accordance with the assertion.

The Niryat Protsahan Yojna will search to enhance entry to reasonably priced commerce finance for MSMEs via a variety of devices reminiscent of curiosity subvention, export factoring, collateral ensures, bank cards for e-commerce exporters, and credit score enhancement help for diversification into new markets. “Subvention we are going to give after discussing with banks,” Vaishnaw stated.

Officers stated that the speed of curiosity subvention to range throughout markets and might be round 3.5% for riskier markets.

The Niryat Disha scheme will concentrate on non-financial components to reinforce market readiness and competitiveness to succeed in extra geographies.

Credit score help

The Credit score Assure Scheme for Exporters (CGSE) will present 100% credit score assure protection for extending further credit score services as much as ₹20,000 crore to eligible exporters, together with MSMEs to reinforce liquidity for them.

The CGSE will present collateral-free working capital of as much as 20% of sanctioned export limits, with credit score ensures on loans as much as ₹50 crore.

The scheme is predicted to reinforce the worldwide competitiveness of Indian exporters and help diversification into new and rising markets.

“We held intense discussions within the final one and a half months. It is vitally necessary to help Indian exporters. That is vital,” Vaishnaw stated.