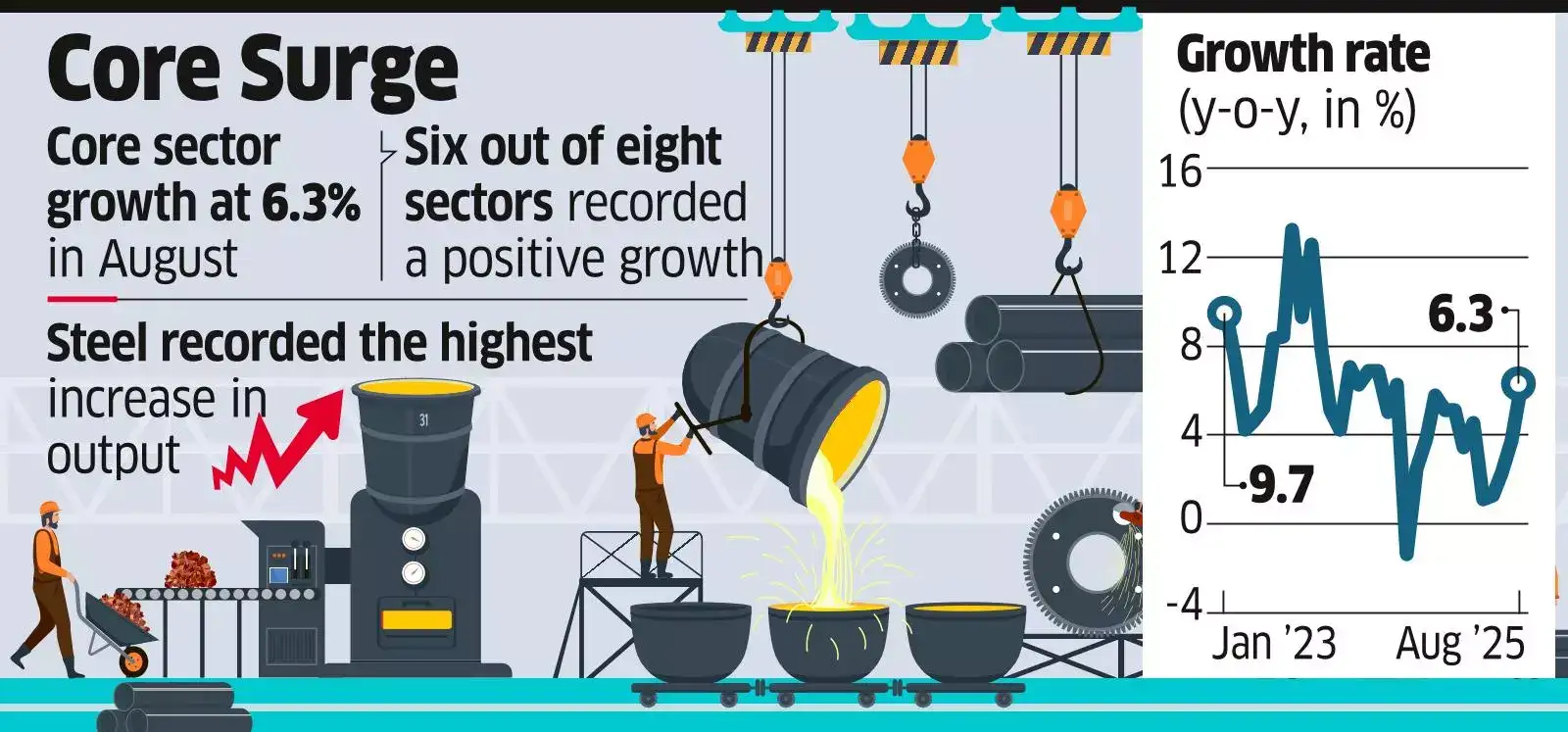

The eight infrastructure industries, which account for 40.27% weight within the Index of Industrial Manufacturing, had grown 3.7% in July and had shrunk 1.5% in August, 2024. For the primary 5 months of FY26, common core sector progress stood at 2.8%, decrease than 4.6% within the corresponding interval final yr, knowledge confirmed.

Industrial output had risen to a four-month excessive of three.5% in July and the newest core sector print is predicted to supply a elevate. IIP knowledge shall be launched on September 29.

Score company ICRA initiatives IIP progress at 4.5-5.5% for August, supported by a turnaround within the efficiency of mining output, which has seen a contraction in each month throughout April-July 2025. Financial institution of Baroda expects 4.5-5%, whereas Ind-Ra estimates 5.5%.

Coal, metal and cement sectors drove up the core sector output, whereas crude oil and pure gasoline dragged it down.

“Aided by a low base, the year-on-year progress in core output expectedly improved in August, with the uptick notably pushed by coal,” stated Aditi Nayar, chief economist at ICRA. Coal output rose by 11.4% year-on-year in August after recording contractions within the earlier two months. Metal additionally posted strong progress of 14.2%, the best amongst eight industries.

“Core sector progress for August is encouraging, pushed primarily by excessive progress in metal, adopted by cement, indicative of heightened exercise within the infrastructure house,” stated Madan Sabnavis, chief economist at Financial institution of Baroda.

Cement sector recorded 6.1% progress, adopted by fertilisers (4.6%), electrical energy (3.1%), and refinery merchandise (3%).

“Though the expansion in cement sector output stood comparatively higher, it remained at a 10-month low in view of the monsoon fury in numerous components of the nation in August,” stated Paras Jasrai, affiliate director at India Scores and Analysis (Ind-Ra). However, crude oil and pure gasoline recorded a contraction of 1.2% and a pair of.2%, respectively.

Outlook

Trying forward, Sabnavis expects building exercise to choose up because the monsoon retreats, offering a lift to cement demand, whereas fertiliser output is more likely to improve as shares are constructed up for rabi sowing. Ind-Ra expects core sector output progress of round 5% in September.