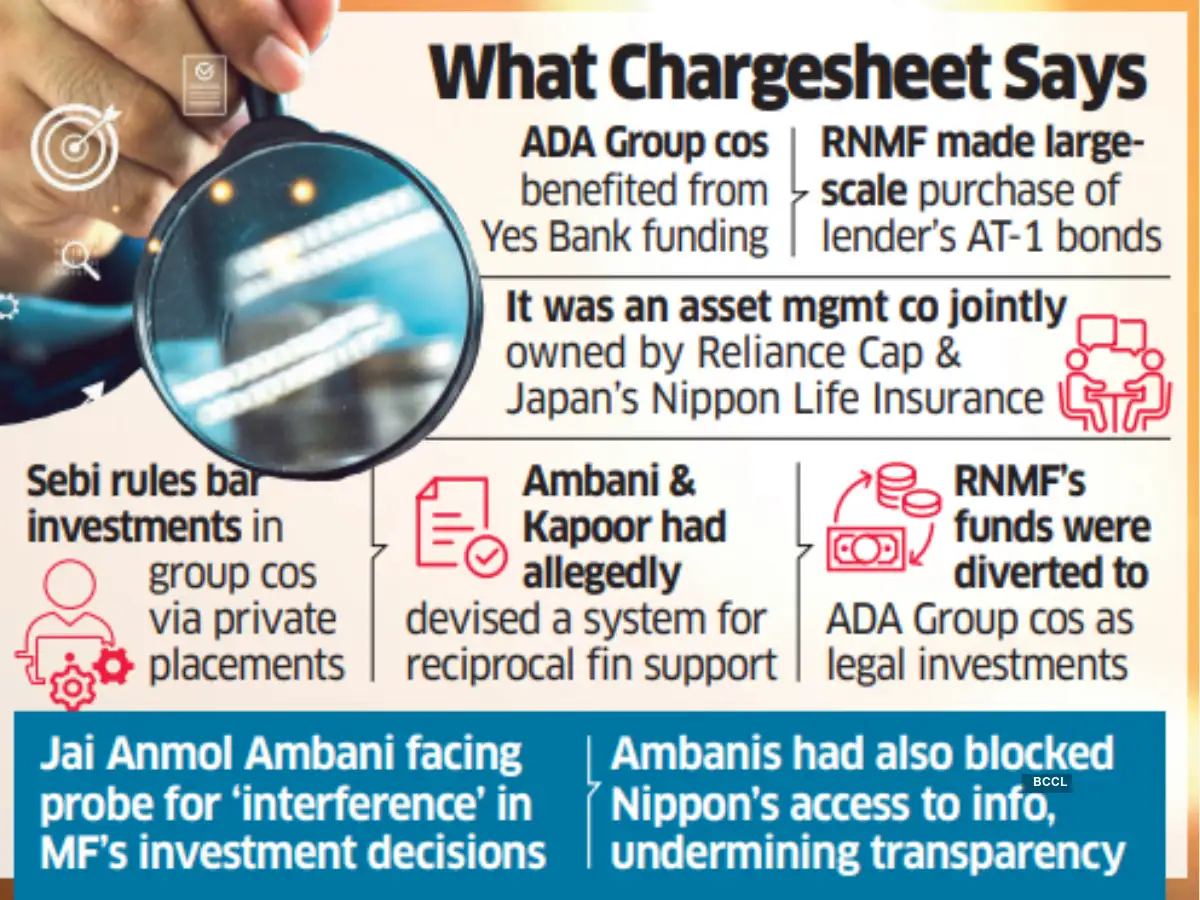

In keeping with the company, funds have been repeatedly disbursed, recycled, and repaid amongst ADA Group corporations, Sure Financial institution, and Reliance Nippon Asset Administration (RNAM) — an asset administration firm collectively owned on the time by Reliance Capital and Japan's Nippon Life Insurance coverage.

The CBI mentioned these interlinked transactions have been structured to bypass the Securities and Change Board of India's (Sebi) mutual fund rules, which prohibit investments in group or affiliate corporations by means of non-public placements.

In keeping with the chargesheet submitted to a particular courtroom, Ambani and Kapoor allegedly colluded to engineer a system of reciprocal monetary assist. Whereas ADA Group corporations benefited from large-scale funding by means of Sure Financial institution, the latter acquired important investments in its capital devices from Reliance Nippon Mutual Fund (RNMF) — successfully making a round circulation of funds to prop up the monetary well being of each side.

Investigators alleged that Ambani's son Jai Anmol Ambani instantly influenced funding choices at RNMF at the same time as the corporate was getting ready to listing on the inventory exchanges.

Lens on Jai Anmol's Position

In keeping with the CBI, RNMF had entry to massive quantities of public cash from basic buyers for funding in long-term debt devices.

To beat Sebi restrictions on investing in group corporations, Ambani and Kapoor allegedly designed an association that allowed RNAM's funds to be diverted into ADA Group's corporations below the guise of official investments.

As per the company, RNMF's large-scale buy of Sure Financial institution's AT-1 bonds and Sure Financial institution's simultaneous funding in ADA Group debt papers — was part of this association. The CBI additionally informed the courtroom that it's probing the function of Jai Anmol Ambani.

The investigation discovered that Morgan Credit Pvt Ltd (MCPL), a promoter entity of the Kapoor household, issued ₹550-crore price of non-convertible debentures (NCDs) in July 2017, permitted by its board members Radha Kapoor and Roshini Kapoor. The debentures have been allotted to RNMF, following a trustee settlement signed with Milestone Trusteeship.

On the similar time, Sure Financial institution was struggling to promote ₹250 crore price of NCDs issued by ADA Group agency Reliance Dwelling Finance (RHFL) in December 2016, after the paper got here below a credit score watch. The debt funding committee of RNMF on August 3, 2017, permitted the acquisition of RHFL's NCDs price ₹249.8 crore. The 2 allegedly orchestrated transactions enabled funds from RNMF — raised from retail and institutional buyers — to circulation into MCPL, and allowed Sure Financial institution to dump its dangerous publicity to Reliance Group papers with none loss. The CBI alleged that Ambani and Kapoor met to finalise their mutual funding plans on October 6, 2017.

Quickly after, Sure Financial institution initiated proposals to subscribe to ₹2,900-crore price of NCDs issued by ADA Group monetary corporations Reliance Capital, Reliance Business Finance, and Reliance Dwelling Finance. Then again, RNMF invested ₹1,750 crore in Sure Financial institution's AT-1 bonds by means of non-public placement on October 18, 2017.

This was adopted by funding of one other ₹500 crore in two tranches on October 27 and December 4, 2017, taking the whole publicity to ₹2,250 crore.

The CBI alleged these transactions have been a part of a “quid-pro-quo” with Sure Financial institution, offering large-scale funding to ADA Group corporations in change for RNMF's investments in Sure Financial institution's capital devices.

ET reviewed the chargesheet.

ADA Group didn't reply to ET's emailed queries as of press time Saturday.