An inner committee, beneath a senior Earnings Tax (I-T) officer, will look at the interaction between the statute and the I-T Act, envisage totally different eventualities of taxability and their authorized implications, factors of battle with I-T rules, challenges confronted in invoking the regulation, and the dealing with of the mountain of information obtained from numerous international locations.

An individual conversant in the event stated that senior tax practitioners, whose views might be sought, might put throughout the purpose that the panel ought to revisit sure robust options of the regulation that permit the imposition of stiff fines – far increased than the penalties beneath the I-T Act – and the initiation of prosecution proceedings for failing to reveal an abroad asset.

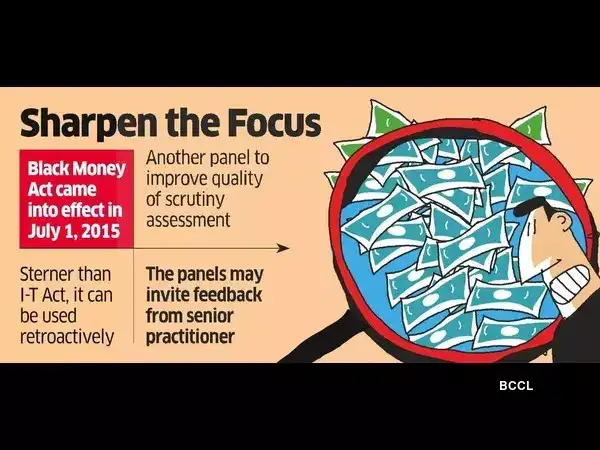

The committee is headed by Amal Pusp, Principal Chief Commissioner of I-T for the Uttar Pradesh (East) area, stated an official within the tax division. One other inner committee, beneath Chief Commissioner Jayaram Raipura, will examine methods to enhance the standard of scrutiny assessments.

The Black Cash (Undisclosed Overseas Earnings and Belongings) and Imposition of Tax Act, 2015 (or BMA) got here into impact on July 1, 2015. Launched by a brand new authorities that had made anti-corruption a serious political plank, the BMA sought to beat the hurdles within the I-T Act and tax cash stashed away in Swiss and offshore financial institution accounts, discretionary trusts in tax havens, and unlisted corporations whose true helpful homeowners stay hidden. Nevertheless, regardless of the strict provisions of the regulation, tax restoration beneath the BMA has fallen wanting expectations.The choice to kind the panel was taken earlier this yr.DIGGING UP THE PAST, PUNISHING REPORTING LAPSES

Essentially the most critical aspect of the BMA is the ability given to the I-T division to query undisclosed international property acquired many years in the past however found now. Underneath the regulation, the yr when the tax division obtains such info is deemed to be the yr by which the earnings was earned by the suspect.

Underneath the I-T Act, the tax workplace can return as much as 5 years to drag up a taxpayer if the escaped earnings is ₹50 lakh or extra; it is three years if the undeclared earnings is lower than ₹50 lakh. However the BMA could be invoked retroactively to probe earnings generated (or property created) effectively earlier than the regulation was enacted.

In accordance with Ashish Mehta, accomplice on the regulation agency Khaitan & Co, “One hopes a realistic view is taken and the federal government reconsiders the presumption enshrined beneath Part 72(c) of the BMA, which intends to get rid of time-barring provisions. The presumption causes grave hardships as taxpayers could also be anticipated to elucidate sources of very previous property, the information of which can not have been retained in view of considerable lapse of time. The BMA's retrospective nature has been challenged in writ petitions, particularly regarding property which weren't in existence on the time of introduction of the Act.”

Underneath the BMA, a 30% tax and 90% penalty may put a burden of 120% of the worth of undisclosed property on a taxpayer. In contrast with this, the utmost outgo (together with fines) beneath the I-T Act is 90%. Furthermore, whereas an individual could be prosecuted beneath the I-T Act for not paying tax, beneath the BMA prosecution could be initiated merely for non-reporting of a international asset, even when the supply of funds is reputable and the asset was acquired with tax-paid cash.

If tax payable by an individual is ascertained beneath the BMA, it's thought of a scheduled offence beneath the Prevention of Cash Laundering Act (PMLA). In such circumstances, tax officers can ask the Enforcement Directorate – which administers the PMLA and investigates international alternate violations – to take acceptable motion. Shortly after the BMA was handed, the PMLA was modified to include this provision. “The present regulation requires modification because it doesn't have an exclusion provision to present profit to real assessees. The federal government ought to goal ordinary offenders and never residents who've formally earned property exterior India whereas overseas however did not disclose them after changing into tax residents of India. There are various such situations, like insurance coverage premiums formally remitted from India however not disclosed,” stated Rajesh P Shah, accomplice on the CA agency Jayantilal Thakkar & Firm.

The federal government, some consider, ought to come out with a brand new disclosure scheme. “The 2015 scheme had debarred many prepared taxpayers from making disclosures. Prosecution complaints devour time, effort, and assets of taxpayers and the administration. As we speak, many taxpayers might be prepared to settle the circumstances, which can even end in income era,” stated Mehta.