This new provision, together with different procedures to salvage tax, is included within the revised India-Belgium tax treaty which was notified by the finance ministry on Monday.

Underneath the amended treaty, Belgium would share information pertaining to even these points that date again to the interval earlier than the settlement between the 2 nations got here into power.

Legal tax issues relate to points involving ‘intentional conduct' that are liable to prosecution underneath prison and tax legal guidelines in India.

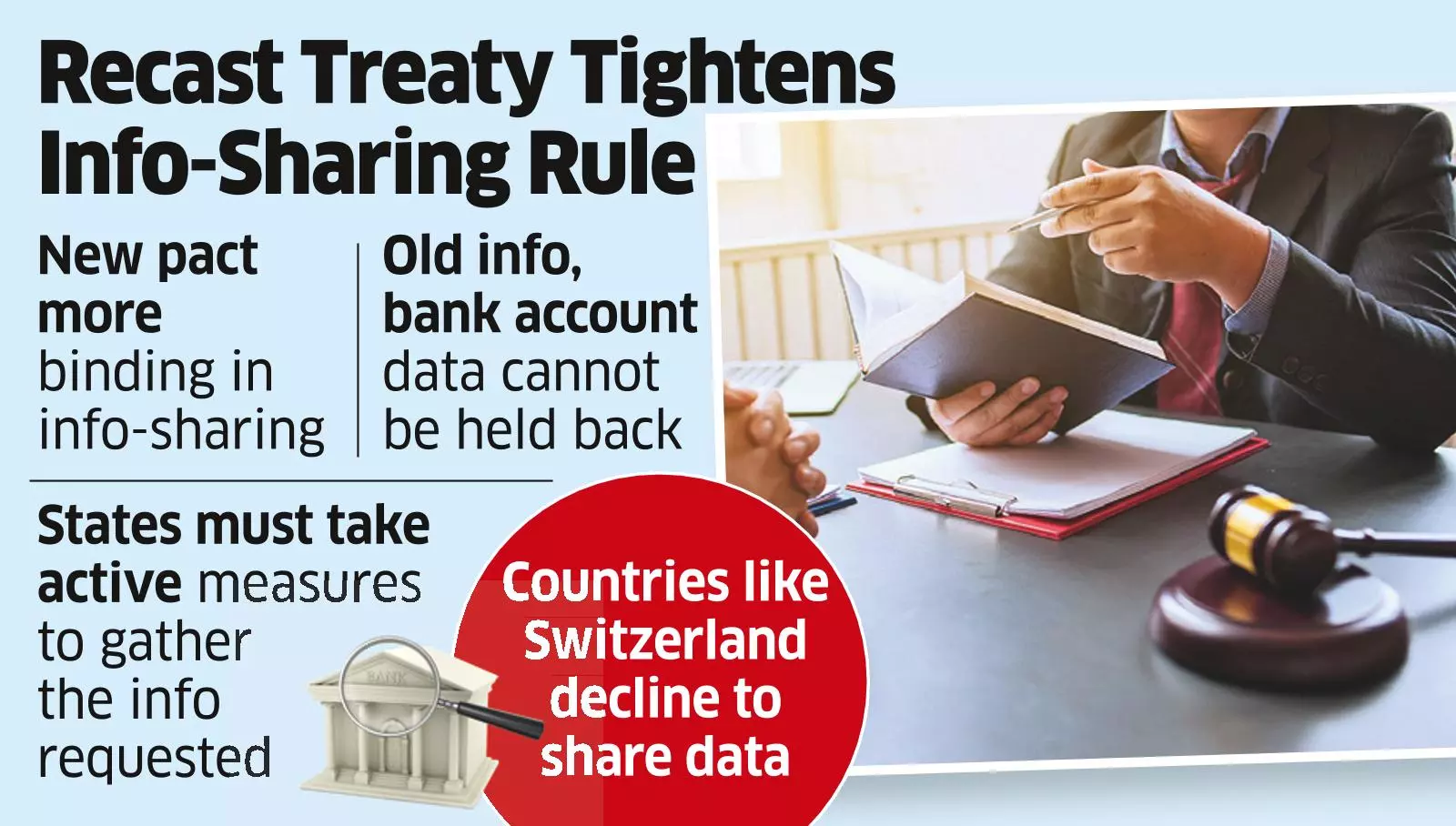

Revised treaty opens entry to previous offshore information for tax probes

Info like previous transaction data with abroad banks, account opening kinds, offshore belief deeds, date of incorporation of overseas firms and their authentic shareholdings assist the Revenue tax (I-T) division to construct their instances towards suspected tax offenders.

Nonetheless, the closing date earlier than which nations are reluctant to share info has been a vexed situation. As an illustration, India has been inundated with information on Swiss financial institution accounts and their beneficiaries, Switzerland is unwilling to half with info previous to April 1, 2011, when the protocol to amend the India-Switzerland double taxation avoidance Treaty got here into impact.

Requested whether or not an analogous clause may very well be launched within the treaty with Switzerland, Ashish Mehta, associate at Khaitan & Co, mentioned, “Indian tax administration has been very lively in using these avenues of looking for info from numerous nations and one can anticipate related modifications being proposed and negotiated with different treaty nations as nicely. Steady steps are being taken globally to facilitate and ease sharing of data amongst nations. The modification of the tax treaty with Belgium is another step in that course.”

The treaty with Belgium was signed in April '93 and the protocol resulting in the present gazette notification was initiated in March 2017. “It marks a defining level in India's treaty framework because it's for the primary time, a tax treaty explicitly articulates the idea of ‘prison tax issues', which till now was largely confined to standalone Tax Info Trade Agreements. Equally important are the far-reaching modifications to the trade of data and tax assortment articles,” mentioned Ashish Karundia, founding father of the CA agency Ashish Karundia & Co.

A number of the stipulations of the amended treaty are: a contracting state can not decline to produce info solely as a result of it has no home curiosity in such info; info can't be held again on the grounds that it's held by a financial institution or monetary establishment or nominees or particular person appearing in a fiduciary capability; and, the state which receives request or tax declare should take “measures conservancy” – like freezing property – even whether it is owed by an individual who has the best to forestall its assortment.

“With all this, the revised provisions remove earlier limitations linked to the scope of taxes lined, obligating each jurisdictions to trade info even within the absence of home tax curiosity. The removing of banking and fiduciary secrecy, together with the extension of mutual help in tax assortment to non-residents and third-country taxpayers, represents a significant step in direction of aligning India's treaty follow with world transparency norms,” mentioned Karundia.

Whereas the knowledge can be utilized for functions like assortment and enforcement of particular legal guidelines, the treaty permits the knowledge to be disclosed in public court docket proceedings. Such disclosures could pave the way in which for different businesses just like the Enforcement Directorate to step in.