In case of rejection or return of a mortgage software, it should be authorised by the subsequent larger authority and clearly communicated to the coed with causes for the choice, they stated.

“A collection of conferences have been held with banks during the last two months to debate delays in processing of schooling mortgage functions,” a authorities official stated on situation of anonymity, including that it has been determined that lenders will guarantee selections on mortgage functions are made inside three to 5 working days.

Sanction of schooling loans is predicated on correct documentation and will depend on different elements together with co-applicant or guarantor. The disbursement is completed in levels as per demand on to the academic institute. The common time for many banks in regular course is inside a month.

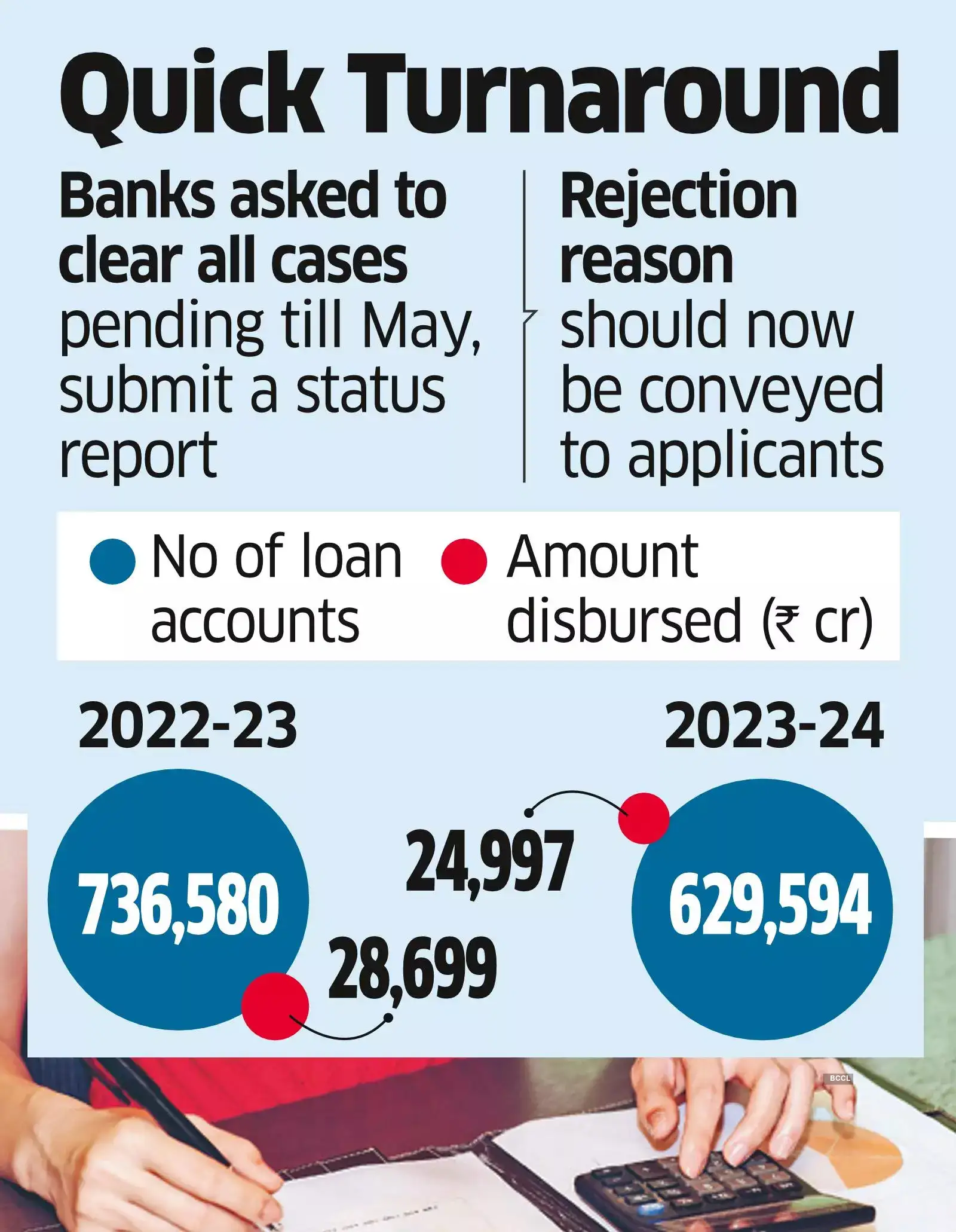

Banks have additionally been directed to clear all instances pending until Could and submit a standing report.

The transfer follows a number of representations to the federal government on the problem. “There have been some instances the place loans had been sanctioned, however disbursals had been on maintain as a consequence of unsatisfactory documentation. These instances have additionally been placed on the quick observe,” the official stated.

Banks have been advised to hunt solely these paperwork which can be stipulated by Indian Banks' Affiliation Mannequin Schooling Mortgage Scheme.

A senior financial institution govt stated that lenders had already begun aligning their mortgage working system with the Vidya Laxmi portal.