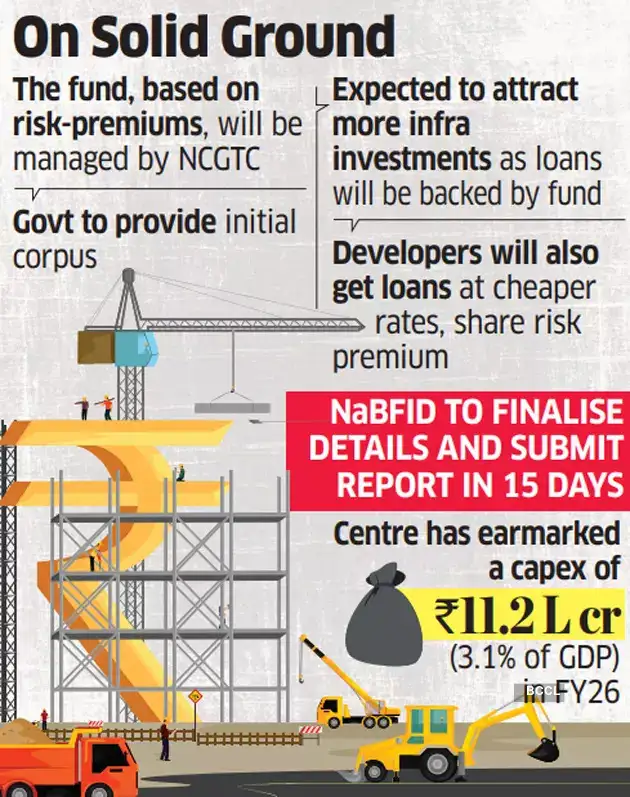

The fund is anticipated to extend credit score movement into massive infrastructure initiatives by encouraging lenders to take bigger exposures. Managed by Nationwide Credit score Assure Trustee Firm, it should underwrite improvement dangers of recent initiatives.

Discussions on Threat Premium

The federal government will present the preliminary corpus. “The concept is to cowl dangers arising as a result of coverage uncertainty and components exterior the management of undertaking builders,” mentioned an official conscious of the matter. The fund will solely take up new infrastructure initiatives and canopy improvement danger, which can embody delays and value overruns on account of non-commercial dangers, he added.

Whereas the discussions are in preliminary levels, Nationwide Financial institution for Financing Infrastructure and Growth (NaBFID) is anticipated to submit its suggestions for the proposed fund inside two weeks. “NaBFID will now maintain extra discussions on in what quantity the chance premium shall be paid by the authority and the developer, the form of danger premium to be paid, the circumstances underneath which assure invocation will set off and every other further safeguards,” a financial institution govt mentioned.

The proposed fund will assist mitigate the chance of the undertaking builders in instances the place initiatives are delayed as a result of land acquisition, environmental clearance, and different extraordinary circumstances, he mentioned. NaBFID, arrange in 2021, is a specialised improvement finance establishment geared toward supporting India's infrastructure sector. One other govt from a staterun monetary establishment mentioned it will be significant that builders additionally pay a premium in order that it ensures accountability whereas protecting exterior dangers.Points Relating to Financing

India requires an funding of round $4.5 trillion by 2040 to develop the infrastructure for sustaining its financial development. The central authorities has earmarked a capital expenditure of `11.21 lakh crore, or 3.1% of GDP, for the present fiscal yr. In a press release on Thursday, the finance ministry mentioned monetary companies secretary M Nagaraju held a gathering to debate points associated to financing within the infrastructure sector.