Addressing the GoM tasked to look at charge rationalisation, the way forward for the compensation cess and insurance coverage, finance minister Nirmala Sitharaman mentioned the three-pronged GST reforms will search to offer higher aid to shoppers, farmers, the center class and MSMEs whereas guaranteeing a simplified regime. Prime Minister Narendra Modi had in his Independence Day deal with introduced an overhaul of the eight-year-old oblique tax, calling it a Diwali reward for the individuals.

The Centre has proposed scrapping the 12% and 28% charges and retaining only a two-slab construction of 5% and 18%, together with a particular charge of 40% for six-seven gadgets together with so-called sin items reminiscent of cigarettes and luxurious vehicles.

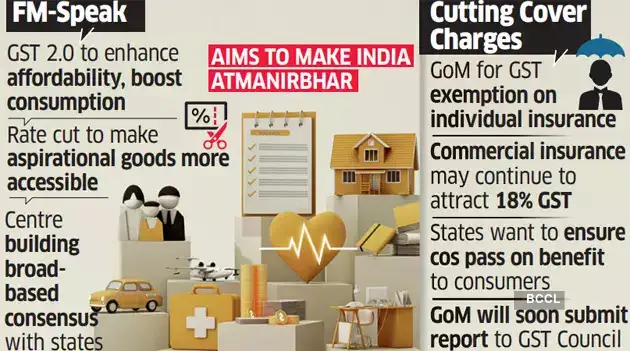

Sitharaman mentioned the GST 2.0 reforms are primarily based on three pillars—structural reforms, charge rationalisation and ease of doing enterprise —and can make the nation Atmanirbhar or self-reliant. She underscored that the Centre is dedicated to constructing a “broad-based consensus with the states within the coming weeks within the spirit of cooperative federalism”. The reformed GST will “improve affordability, enhance consumption and make important and aspirational items extra accessible to a wider inhabitants,” the minister instructed the GoM.

Predictability in GST Coverage

The GoM on charge rationalisation will deliberate on the Centre's proposal for the broader GST revamp Thursday and make a advice to the GST Council, which is able to probably meet in September, ET had reported. The GST Council is the apex decision-making physique for the levy.Sitharaman mentioned the proposed modifications will right inverted responsibility constructions to chop enter tax credit score accumulation and enhance home worth addition, in addition to resolving classification points for less complicated compliance and fewer disputes. The transfer will guarantee stability and predictability in GST coverage to strengthen trade confidence and longterm planning, she added.Cowl Story

The 13-member GoM on insurance coverage, headed by Bihar deputy chief minister Samrat Choudhary, that met Wednesday has favoured aid for people. Business and insurance coverage merchandise might proceed to draw GST at 18%. “The Centre's proposal is evident that particular person insurance coverage insurance policies must be exempt from GST. This has been mentioned and the GoM report will probably be offered to the council,” Choudhary instructed reporters after the assembly. At present, well being and life insurance coverage premiums appeal to 18% GST.

Some states have reservations over whether or not the trade will cross on the advantages to shoppers, on condition that they might not get enter tax credit score on this. “Nearly all states had been in favour of the proposal, however they requested the GST Council to plot a mechanism by which the GST charge minimize advantages are handed on to the client,” mentioned GoM member and Telangana deputy chief minister Mallu Bhatti Vikramarka. The exemption will end in an estimated annual income lack of Rs 9,700 crore, he mentioned.

Chaudhary mentioned the GoM will submit its report back to the GST Council, which is able to embody views and considerations expressed by some state finance ministers. “All members have given their approval for reducing charges. Some states have given their very own views,” he mentioned, including {that a} remaining name on charges could be taken by the council. The GoM on well being and life insurance coverage was arrange in September final yr.