Till not too long ago, prosperous people who positioned small bets on lengthy pictures had been focused with a weird “angel tax,” which considered startups' fundraising as taxable earnings. Now that the federal government has lastly scrapped the draconian levy, the Securities and Change Board of India has sown recent seeds of disquiet for individuals who wish to strive early-stage allocations by way of collective funding plans: It needs them to get accredited.

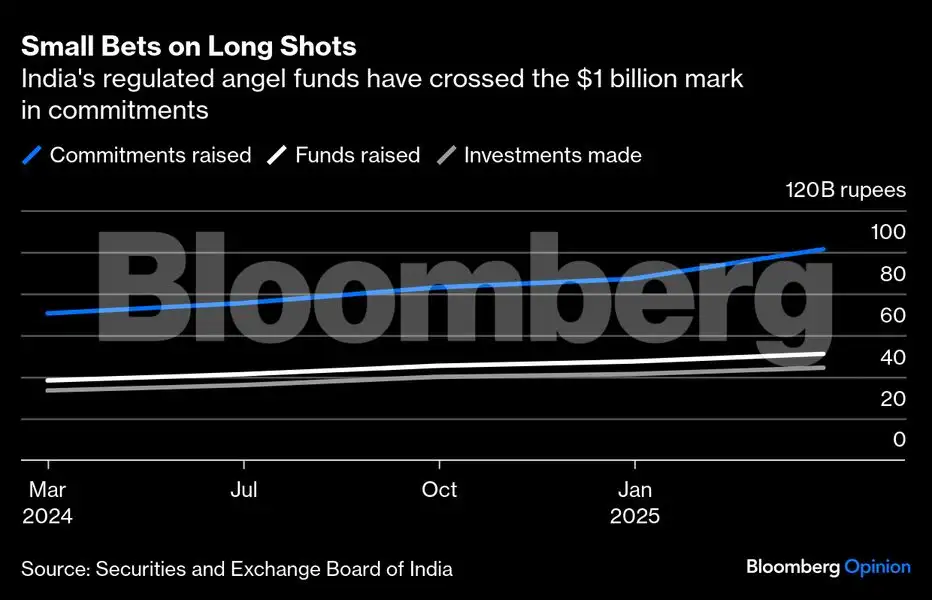

Commitments into angel funds have swelled by 44% over the previous yr, and investments have surged by a 3rd. These are affordable progress charges, however the SEBI appears to imagine that it can provide an extra increase to the “ease of doing enterprise.”

Though that's a welcome sentiment, some warning is warranted. As a risk-taking tradition spreads past established enterprise households, new sources of finance should emerge. If angel funds exit the scene as a result of their traders don't wish to search accreditation, many promising entrepreneurs could should drop out earlier than their first assembly with enterprise capital or non-public fairness.

The regulator means effectively. It needs to unshackle angel traders from India's Firms Act, which limits participation in non-public placement of securities to 200 subscribers. Any extra would require public choices. However this rule is unfair to regulated funds, the place skilled managers are required to have pores and skin within the sport. Plus, the dangers are defined in a memorandum, and express investor consent is required for every wager. There's clearly a necessity to differentiate between non-public placements and angel investing. However how does the regulator sidestep a legislation made by parliament?

It has provide you with a plan. From subsequent yr, people who put money into angel funds might be handled as Certified Institutional Patrons. For the reason that legislation exempts QIBs from the 200-person rule, managers will not should restrict participation. This “would permit angel funds to indicate alternatives to a wider pool of eligible traders, whereas staying in conformity with the Firms Act,” the SEBI mentioned final month.There's a catch, nevertheless. Since people aren't actually establishments, the SEBI needs them to grow to be accredited traders like within the US to qualify for the exemption. They'll have a yr to regulate to the brand new regime. Bother is that whereas 13% of Individuals meet the thresholds for getting non-public securities, up to now solely 650 Indians have efficiently utilized for accreditation, based on ET Wealth. That makes them rarer than the Bengal tiger, an endangered species.

Bloomberg

BloombergDo solely 0.00005% of Indians earn greater than 20 million rupees ($230,000) yearly, or have a internet price in extra of $860,000? Not likely. Counting simply the highest tax payers, no less than 60,000 folks ought to simply meet these minimal requirements. However to get accredited, folks have to supply proof to 3rd events. In a rustic the place authorities ship tax payments to roadside vegetable distributors by tracing QR-code-based funds, it's in no one's curiosity to furnish documentation displaying how wealthy they're. Not when the reminiscence of the disastrous “angel tax” continues to be recent.

Even when the purpose is to drive accreditation, why single out startup traders who're doing one thing worthwhile with their time and cash? That already units them other than the 9 out of 10 Indian retail merchants betting on fairness choices and being taken to the cleaners by huge whales like Jane Avenue. The general public-market on line casino is the place the regulator must police participation. Personal markets don't want the identical stage of scrutiny past guaranteeing that the capital coming into fledgling companies just isn't tainted.

At current, angel traders solely self-certify a minimal internet price to their fund supervisor. The thresholds are low, as is the compliance burden. It's a lax course of. Not everybody who's being invited to dabble in unlisted securities has the danger urge for food for it. However so long as they're giving knowledgeable consent, they are often safely left alone. It's the insurance coverage and banking regulators that should put a cease to way more widespread misleading promoting of their industries. Why's the SEBI dashing to repair what isn't damaged?

The $1.2 billion that angels have dedicated up to now could not produce famous person enterprises. That's high quality, so long as a rising pot of cash helps nurture some gritty entrepreneurs. As I wrote final week, millennial and Gen Z billionaires amongst India's conventional family-owned companies are tired of enterprise. They don't fancy their possibilities in opposition to both massive tycoons, or sensible startup founders. However the latter want financing.

The SEBI's different concepts are laudable. Enjoyable the ground and cap on investments, casting off focus limits on publicity, and permitting funds to maintain backing startups as they mature will enhance returns. However forcing traders to get accredited by third events? That's certain to backfire, until the SEBI itself obtains their permission to question the tax returns database. A easy sure or no reply to the eligibility query, primarily based on data they've already shared with tax authorities, might assist improve the variety of 650 accredited traders manifold. The wealthy in India are removed from endangered, however they don't wish to flaunt their stripes any greater than they should.